FBR Increased Sale Tax Rate in Pakistan 2023

FBR Increased Sale Tax Rate in Pakistan 2023. Standard rate of General sales tax has been increased from 17% to 18%. Moreover, it would go into effect immediately from 15 February 2023.

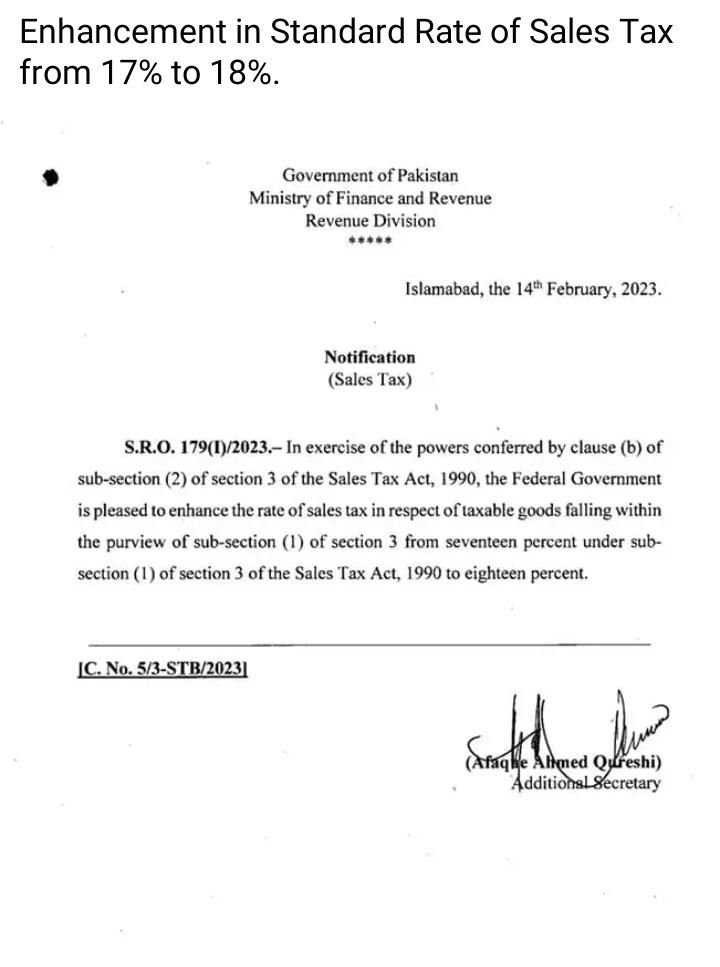

For this purpose Federal Board of Revenue (FBR) has issued Statutory Regulatory Order (SRO) No. SRO 179(1)/2023 Dated: 14th February 2023.

Statutory Regulatory Order (SRO) No. SRO 179(1)/2023

According to SRO issued by FBR:

“S.R.O. 179(1)/2023.— In exercise of the powers conferred by clause (b) of sub-section (2) of section 3 of the Sales Tax Act, 1990, the Federal Government is pleased to enhance the rate of sales tax in respect of taxable goods falling within the purview of sub-section (1) of section 3 from seventeen percent under subsection (1) of section 3 of the Sales Tax Act, 1990 to eighteen percent.“

Following the cabinet’s approval of Tax Laws Amendment Bill 2023, the FBR issued the Statutory Regulatory Order (SRO) for raising the General Sales Tax GST rate from standard 17% to 18%.

Moreover, SRO No 178(1)/2023 also issued yesterday for increasing the Federal Excise Duty (FED) on cigarettes.

Moreover, according to media news, the government also approved the GST on hundreds of high-end luxury items at the rate of 25%. Further, government will introduce it through the Tax Amendment Bill 2023. Government will lay down this bill in the parliament on Wednesday (today).