E-Stamping, a flagship project of the Punjab Information Technology Board (PITB), aims to automate the issuance of stamps in Punjab. Since its launch in November 2014, e-stamping has now achieved a milestone of Rs.201.3 billion revenue in 2020 As of December 31, 2020. The total revenue collected using this e-stamping system is over PKR 201 billion. A total of 8.1 million e-stamps issued during the year with over 10.9 million transactions.

E-stamping ensures smoothing of property and business transactions in Punjab. This is to minimize the sale and purchase of fraudulent and counterfeit stamp papers. PITB has also developed a mobile app for auditors so that they can easily verify e-stamp paper and challan 32-A. The names of the buyers, sellers and the person through whom the stamps purchased entered into the system along with their CNIC number. PITB has also set up a central database for e-stamping system which has made the verification process easier for the citizens.

PITB along with other stakeholders launched several apps for the convenience of the people of Punjab. More recently, PITB has introduced a “Rasta App” to help you drive in thick fog. Similarly, for the convenience of teachers, PITB and SED jointly launched an online retirement system. All these projects are playing a key role in making the country digital.

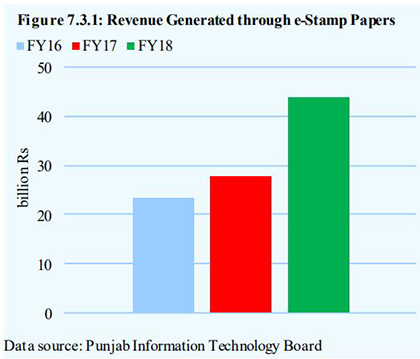

e-Stamping revenue generated in previous years

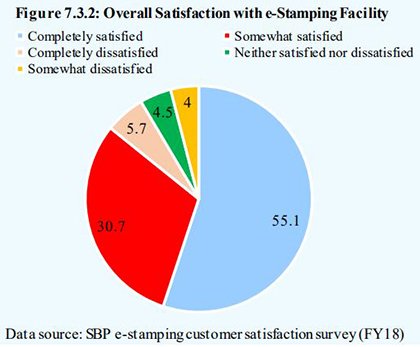

e-stamping facility satisfaction level

LATEST POSTS

- New Taxes on E-commerce Transactions in Pakistan

New Taxes on E-commerce Transactions in Pakistan: In the recent budget (Finance Act 2025) Government of Pakistan has taken some significant steps towards the taxation of local ecommerce industry of Pakistan. The new amendments in the Income tax Ordinance 2001 and Sales Tax Act 1990 will affect all those ecommerce businesses operating through online platforms, websites, or courier based Cash on Delivery (COD) Model. Below are the significant highlights of amendments in tax laws of Pakistan which are necessary for your understanding: Enhanced Definition of “Online Market Place” Through Finance Act 2025, section 2(38B) of income Tax Ordinance 2001 amended and definition of “Online Market Place” has been broadened. It now also includes: These will help buying and selling between multiple parties, whether the platform owns the goods/services or not. New Taxes on E-commerce Transactions in Pakistan for Digitally Ordered Goods/Services Through Finance Act 2025, a new section, 6A in the Income Tax Ordinance, introduces a tax on payments received for digitally ordered goods/services through local platforms (including websites). Applies To:This section applies to all persons receiving payments for goods/services delivered from within Pakistan via online platforms. Excludes:It does not include export proceeds received in Pakistan which are already taxed under sections 154 and 154A. Tax Collection by Payment Intermediaries and & Couriers Under amendment in section 153(2A) of Income Tax Ordinance 2001 through Finance Act 2025: This applies to all payments made for digitally ordered goods and services via local platforms, including websites. Rate of Income tax to be deducted from a payment for digitally ordered goods/services Two different tax rates has been introduced for payments to ecommerce sellers against digitally ordered goods, complete description is here: Sales Tax Collection Responsibility As per Sales Tax Act 1990, the responsibility to collect and pay sales tax on digitally ordered goods is explained here: Rates of Sales Tax on Payments against Digitally ordered goods The applicable rates of sales tax to be deducted are given in the Eleventh Schedule of the Sales Tax Act 1990. The sales tax withheld by the payment intermediary or the courier company will be final discharge of tax liability against the digitally ordered goods by the: AS per the eleventh schedule of Sales Tax Act 1990 the rate of sales tax to withhold to withhold by the payment intermediary / Courier Company will be at the rate of 2% of gross value of supplies. Mandatory NTN & Sales Tax Registration To promote documentation and transparency: Unregistered sellers will not be allowed to operate on their platforms.

New Taxes on E-commerce Transactions in Pakistan: In the recent budget (Finance Act 2025) Government of Pakistan has taken some significant steps towards the taxation of local ecommerce industry of Pakistan. The new amendments in the Income tax Ordinance 2001 and Sales Tax Act 1990 will affect all those ecommerce businesses operating through online platforms, websites, or courier based Cash on Delivery (COD) Model. Below are the significant highlights of amendments in tax laws of Pakistan which are necessary for your understanding: Enhanced Definition of “Online Market Place” Through Finance Act 2025, section 2(38B) of income Tax Ordinance 2001 amended and definition of “Online Market Place” has been broadened. It now also includes: These will help buying and selling between multiple parties, whether the platform owns the goods/services or not. New Taxes on E-commerce Transactions in Pakistan for Digitally Ordered Goods/Services Through Finance Act 2025, a new section, 6A in the Income Tax Ordinance, introduces a tax on payments received for digitally ordered goods/services through local platforms (including websites). Applies To:This section applies to all persons receiving payments for goods/services delivered from within Pakistan via online platforms. Excludes:It does not include export proceeds received in Pakistan which are already taxed under sections 154 and 154A. Tax Collection by Payment Intermediaries and & Couriers Under amendment in section 153(2A) of Income Tax Ordinance 2001 through Finance Act 2025: This applies to all payments made for digitally ordered goods and services via local platforms, including websites. Rate of Income tax to be deducted from a payment for digitally ordered goods/services Two different tax rates has been introduced for payments to ecommerce sellers against digitally ordered goods, complete description is here: Sales Tax Collection Responsibility As per Sales Tax Act 1990, the responsibility to collect and pay sales tax on digitally ordered goods is explained here: Rates of Sales Tax on Payments against Digitally ordered goods The applicable rates of sales tax to be deducted are given in the Eleventh Schedule of the Sales Tax Act 1990. The sales tax withheld by the payment intermediary or the courier company will be final discharge of tax liability against the digitally ordered goods by the: AS per the eleventh schedule of Sales Tax Act 1990 the rate of sales tax to withhold to withhold by the payment intermediary / Courier Company will be at the rate of 2% of gross value of supplies. Mandatory NTN & Sales Tax Registration To promote documentation and transparency: Unregistered sellers will not be allowed to operate on their platforms. - FBR Extends Sales Tax & FED Return Filing Deadline for June 2025

FBR Extends Sales Tax & FED Return Filing Deadline for June 2025 – The Federal Board of Revenue (FBR) has officially extended the last date for filing sales tax and Federal excise Duty Return for the period of June 2025. FBR Extends Sales Tax & FED Return Filing Deadline for June 2025 New due date to file the sales tax and FED return is now 4th August 2025 which was due on 18.07.2025. This extension has been granted to to facilitate the taxpayers that they must ensure their monthly compliance delaying due to technical issues facing on FBR Iris Portal. FBR issued a notification in this regard on his official website and communicated the new extended deadline for filing sales tax return.

FBR Extends Sales Tax & FED Return Filing Deadline for June 2025 – The Federal Board of Revenue (FBR) has officially extended the last date for filing sales tax and Federal excise Duty Return for the period of June 2025. FBR Extends Sales Tax & FED Return Filing Deadline for June 2025 New due date to file the sales tax and FED return is now 4th August 2025 which was due on 18.07.2025. This extension has been granted to to facilitate the taxpayers that they must ensure their monthly compliance delaying due to technical issues facing on FBR Iris Portal. FBR issued a notification in this regard on his official website and communicated the new extended deadline for filing sales tax return. - Budget 2025 Update: FBR Broadens Definition of Online Marketplace

Budget 2025 Update: FBR Broadens Definition of Online Marketplace: In the recent federal budget 2025-26, the Federal Board of Revenue (FBR) has redefined “Online Market Place” for the purpose of regularizing and taxing the fast growing digital economy of Pakistan. One of the important update in the Income Tax Ordinance, 2001, is the redefinition of the term “online marketplace.” The change in definition will bring a massive change to a wide range of digital platforms and sellers, remodeling how e-commerce competitors deals with the tax system in Pakistan. New Definition of “Online Marketplace” Section 2(38B): “online marketplace” means an information technology platform run by e-commerce entity over an electronic network that acts as a facilitator in transactions that occur between a buyer and a seller and includes “online interfaces” that facilitate, for a fee, the direct interaction between multiple buyers and multiple sellers via digital orders for supply of goods and services, with or without the platform taking economic ownership of the goods or providing or rendering the services that are being sold.“

Budget 2025 Update: FBR Broadens Definition of Online Marketplace: In the recent federal budget 2025-26, the Federal Board of Revenue (FBR) has redefined “Online Market Place” for the purpose of regularizing and taxing the fast growing digital economy of Pakistan. One of the important update in the Income Tax Ordinance, 2001, is the redefinition of the term “online marketplace.” The change in definition will bring a massive change to a wide range of digital platforms and sellers, remodeling how e-commerce competitors deals with the tax system in Pakistan. New Definition of “Online Marketplace” Section 2(38B): “online marketplace” means an information technology platform run by e-commerce entity over an electronic network that acts as a facilitator in transactions that occur between a buyer and a seller and includes “online interfaces” that facilitate, for a fee, the direct interaction between multiple buyers and multiple sellers via digital orders for supply of goods and services, with or without the platform taking economic ownership of the goods or providing or rendering the services that are being sold.“ - FBR Opens Tax Return Filing Tax Year 2025 – Great Submit Now

FBR Opens Tax Return Filing Tax Year 2025 – Recently Federal Board of Revenue (FBR) has formally issued the tax return form for Tax Year 2025. It is a great news and now taxpayers can submit their annual income tax returns by using the updated form via the FBR Iris Portal. It is highly recommended to you to file your annual income tax returns well before the last date to avoid tax notices and penalties thereafter. What is Deadline Line for Filing Tax Return? For Filing Tax Return for Tax Year 2025 last date to file tax return for Salaried class, individuals and Partnership businesses is 30th September 2025. For Companies registered under the Companies act 2017 the deadline is 31st December 2025. Who Should File the Income Tax Return? You should file your tax return if you fall in any of the following categories: Benefits of Filing Your Tax Return Following are the benefits of filing tax return in Pakistan. Need Help with Filing your Return? If you need any help in filing your tax return then you may contact us. Contact: Global Tax Consultants, 00923334875413 Address: Office No UM-33, Zainab Tower, Model Town, Link Road, Lahore-Pakistan. https://globaltaxconsultants.pk

FBR Opens Tax Return Filing Tax Year 2025 – Recently Federal Board of Revenue (FBR) has formally issued the tax return form for Tax Year 2025. It is a great news and now taxpayers can submit their annual income tax returns by using the updated form via the FBR Iris Portal. It is highly recommended to you to file your annual income tax returns well before the last date to avoid tax notices and penalties thereafter. What is Deadline Line for Filing Tax Return? For Filing Tax Return for Tax Year 2025 last date to file tax return for Salaried class, individuals and Partnership businesses is 30th September 2025. For Companies registered under the Companies act 2017 the deadline is 31st December 2025. Who Should File the Income Tax Return? You should file your tax return if you fall in any of the following categories: Benefits of Filing Your Tax Return Following are the benefits of filing tax return in Pakistan. Need Help with Filing your Return? If you need any help in filing your tax return then you may contact us. Contact: Global Tax Consultants, 00923334875413 Address: Office No UM-33, Zainab Tower, Model Town, Link Road, Lahore-Pakistan. https://globaltaxconsultants.pk - FBR Biometric Verification Mandatory by 31st July 2025 – What Taxpayers Must Know?

FBR Biometric Verification Mandatory by 31st July 2025 – What Taxpayers Must Know? – If you’re Sales tax registered taxpayers in Pakistan, the deadline is ahead: 31st July 2025 like you did your biometric verification last year in July. Under the provision of proviso to sub-rule (4) of rule 5 of the Sales Tax Rules, 2006, every individual, any member of an association of persons, and a director of a company are required to visit e-Sahulat Centre of NADRA during the month of July every year for biometric re-verification Why FBR Biometric Verification Mandatory by 31st July 2025? You must know that if no biometric verification, then no sales tax return filing. How to do Biometric Verification? You have to go to any NADRA e-Sahulat Centre with your original CNIC for biometric verification of sales tax.

FBR Biometric Verification Mandatory by 31st July 2025 – What Taxpayers Must Know? – If you’re Sales tax registered taxpayers in Pakistan, the deadline is ahead: 31st July 2025 like you did your biometric verification last year in July. Under the provision of proviso to sub-rule (4) of rule 5 of the Sales Tax Rules, 2006, every individual, any member of an association of persons, and a director of a company are required to visit e-Sahulat Centre of NADRA during the month of July every year for biometric re-verification Why FBR Biometric Verification Mandatory by 31st July 2025? You must know that if no biometric verification, then no sales tax return filing. How to do Biometric Verification? You have to go to any NADRA e-Sahulat Centre with your original CNIC for biometric verification of sales tax. - FBR Introduces Multi-Factor Login Authenticator for Sales Tax Users

FBR Multi-Factor Login Authenticator – To ensure privacy, increase of security and simplify access to the sales tax system the Federal Board of Revenue (FBR) through Pakistan Revenue Automation Limited (PRAL) has launched a Multi-Factor Login Authentication system for sales tax registered taxpayers. What are the key features of the new FBR Multi-Factor Login Authenticator? Following are the key features of the new system introduced by the FBR for logging FBR Iris Portal for those taxpayers who are also registered in sales tax with FBR.

FBR Multi-Factor Login Authenticator – To ensure privacy, increase of security and simplify access to the sales tax system the Federal Board of Revenue (FBR) through Pakistan Revenue Automation Limited (PRAL) has launched a Multi-Factor Login Authentication system for sales tax registered taxpayers. What are the key features of the new FBR Multi-Factor Login Authenticator? Following are the key features of the new system introduced by the FBR for logging FBR Iris Portal for those taxpayers who are also registered in sales tax with FBR.