How to Check NTN Number Online in 2023

How to Check NTN Number Online in 2023. The complete procedure will be given here to get and verify the National Tax Number (NTN No) through CNIC, Passport No, Registration, or Incorporation No.

Step-by-step procedure to check National Tax Number (NTN) Online

Let us check the complete step-by-step procedure to get NTN No:

Benefits of Having NTN No

The National Tax Number (NTN) holder and tax Payer have a lot of benefits from the Government tax & fees. Moreover, only taxpayers can get Government contracts and can participate in the auctions. Further, the taxpayer can become a member of the chamber of commerce and Industry of their city. A lower rate of tax on the purchase and sale of properties is charged to NTN holders and with filer status.

Moreover, less tax on the registration of vehicles and a lower rate of withholding tax on the sale of goods and provision of services. Less tax on prize-winning prize bonds and a lower rate of tax on bank profits.

You can follow the steps given here to check and verify the National Tax Number (NTN).

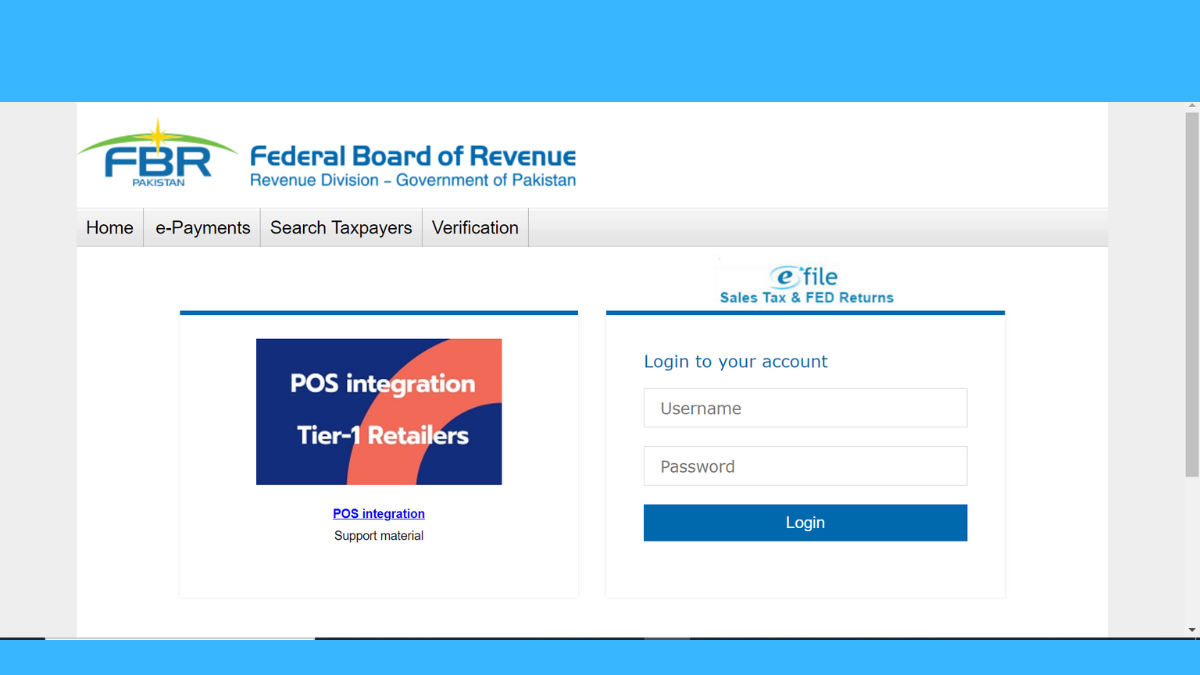

- Visit the Official Website of FBR:

Open a web browser and visit the official website of the Federal Board of Revenue (FBR), Here

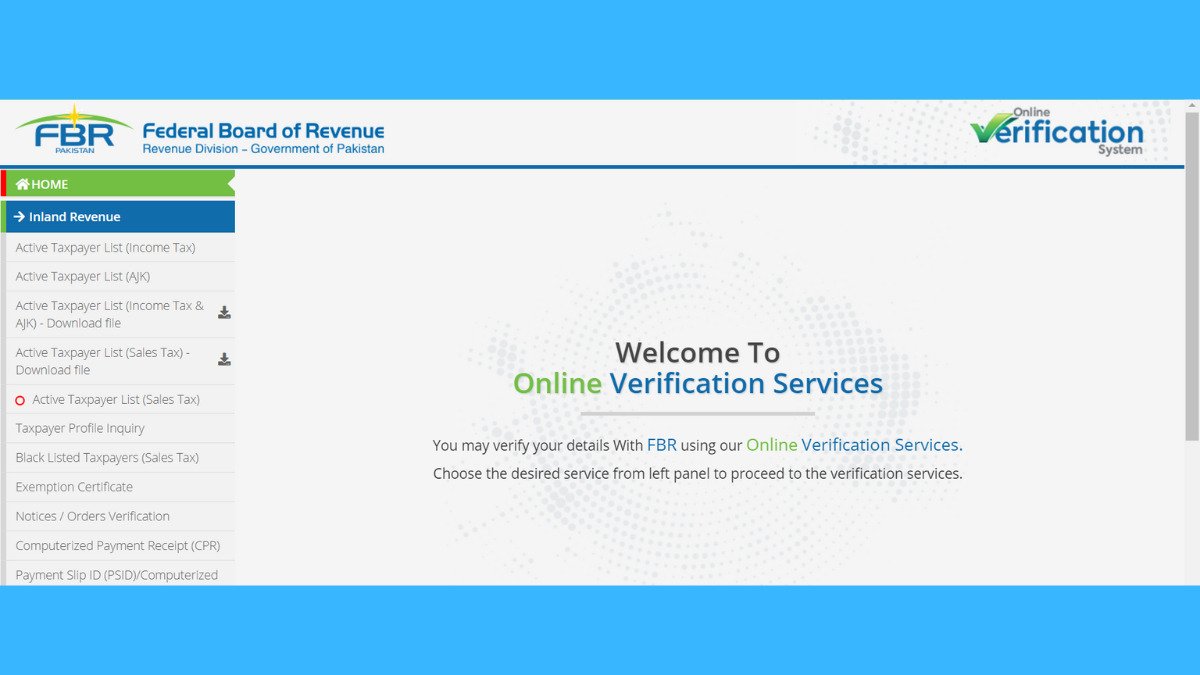

- Navigate to the NTN Verification Section:

Follow the tab “Search Taxpayers“ and then click the tab “NTN Inquiry“. Then click on the “Taxpayer Profile Inquiry”

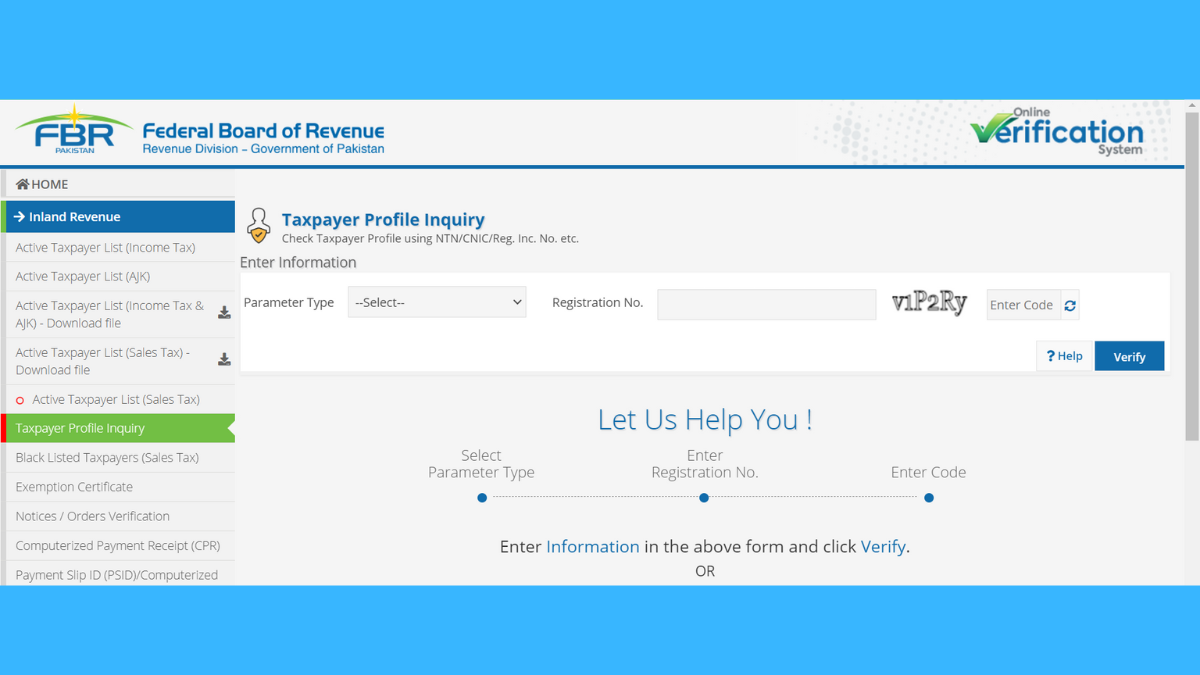

- Enter Required Information:

Select your relevant option from the drop-down button (e.g., NTN, CNIC, Passport No, Registration No, or Incorporation No.)

- Submit and Verify:

Provide your “Registration No” in the registration field (Number Provided by FBR while taxpayer’s registration of National Taxation Number (NTN) or Provide your “CNIC” in the CNIC field or any other parameter and then Provide a captcha against the “Captcha” field. Now enter the “Submit” button.

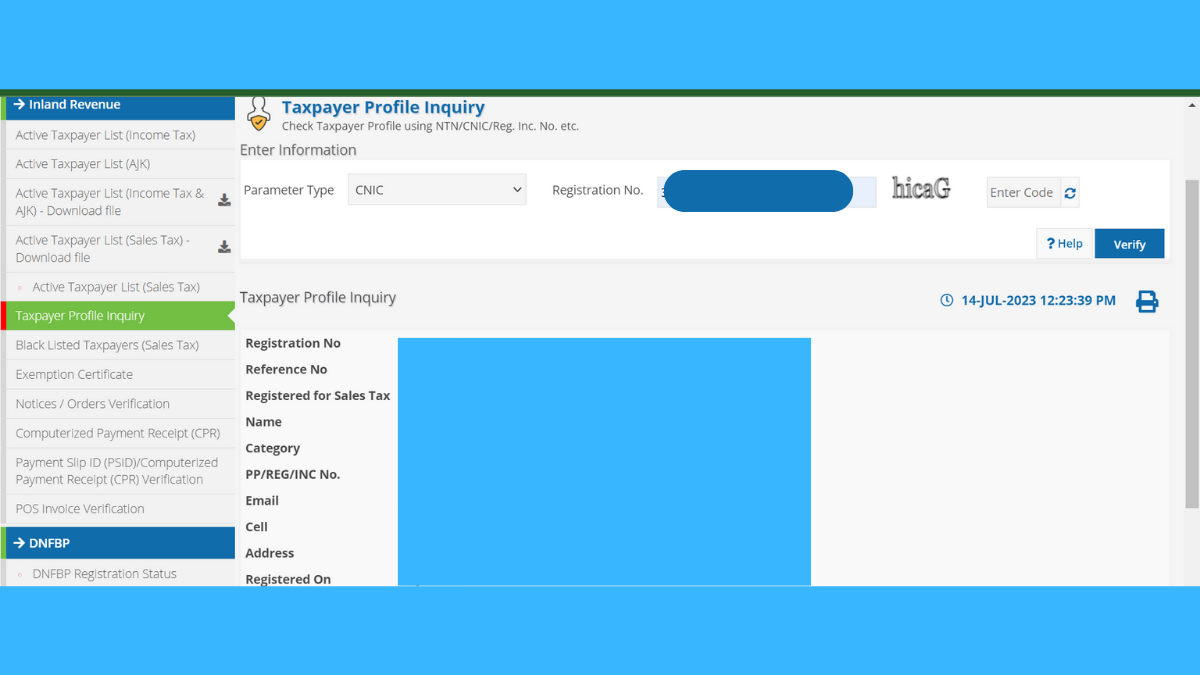

- View the National Tax Number (NTN) Verification Result

After entering all the required information and submitting the request you get the result. Here you will get all the details of the taxpayer like, Taxpayer Name, Address, Cell Number, Email ID, Sales Tax Registered or not, and NTN Registration date. However, you will also get information about the Business name added if any, Business address, and business activities.

- Where is NTN Number?

NTN stands for National Tax Number. Here in the NTN Profile Inquiry/verification result the seven-digit no named “Reference Number” is the NTN number.