How to Recover FBR IRIS Password

How to Recover FBR IRIS Password. After you are ready to provide your documents to your tax consultants for filing an annual income tax return then often you suddenly remember that you changed your FBR Iris password last year which you have forgotten elsewhere.

Then do not worry because you can retrieve it by using forget password option available at the FBR iris portal. You must remember that now password recovery cannot be made through the FBR Maloomat portal through only cell no. Now, you have to approach the FBR Iris portal to recover it by using your cell no as well as e-mail ID.

If your cell no and e-mail used for registration with FBR are not both in your access or any one of them. Then you first need to visit your related Regional Tax Office (RTO) along with your original CNIC. There, you will fill out a form and deposit it with the FBR office to change your particulars with a new cell no and e-mail ID.

After the FBR RTO office changes your particulars with a new cell and e-mail ID then you can easily forget your password and recover it by following the given steps.

Step by Step Procedure to access FBR Iris Password

Here, we will see the step-by-step procedure that how you can access your password for filing your tax return. Let us discuss it:

Step-by-step procedure to recover FBR iris password!

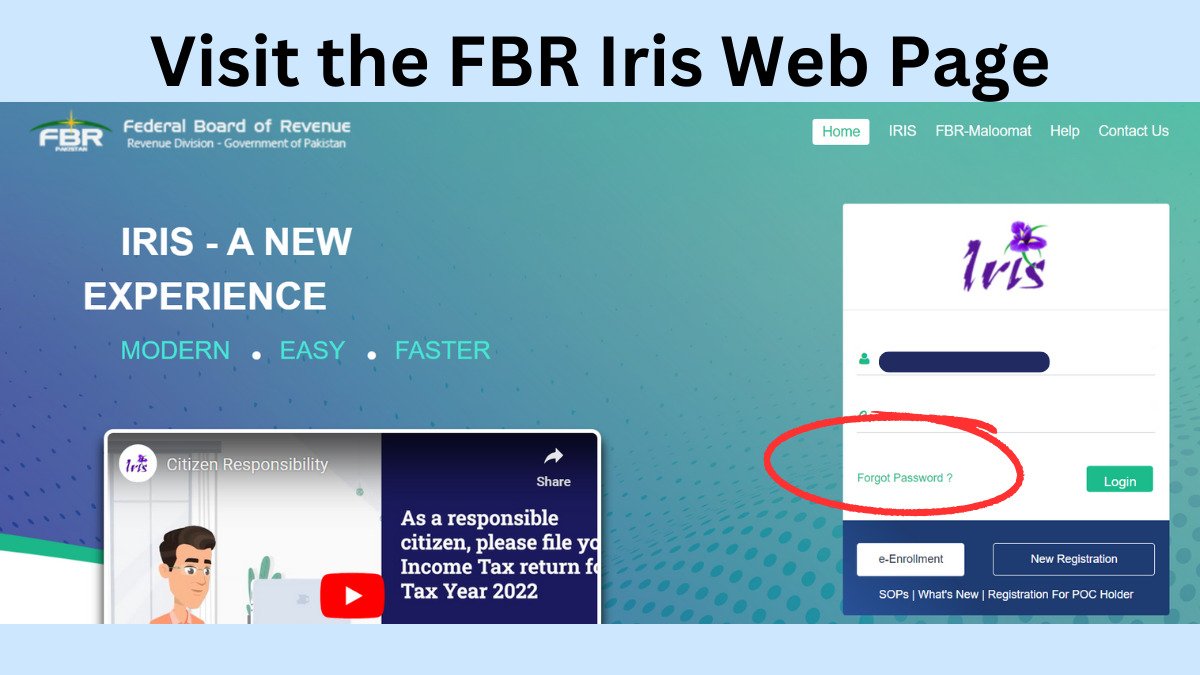

- Visit the FBR Iris Login Page:

Access your FBR iris web portal here (www.iris.fbr.gov.pk) and click on the "Forget Password"

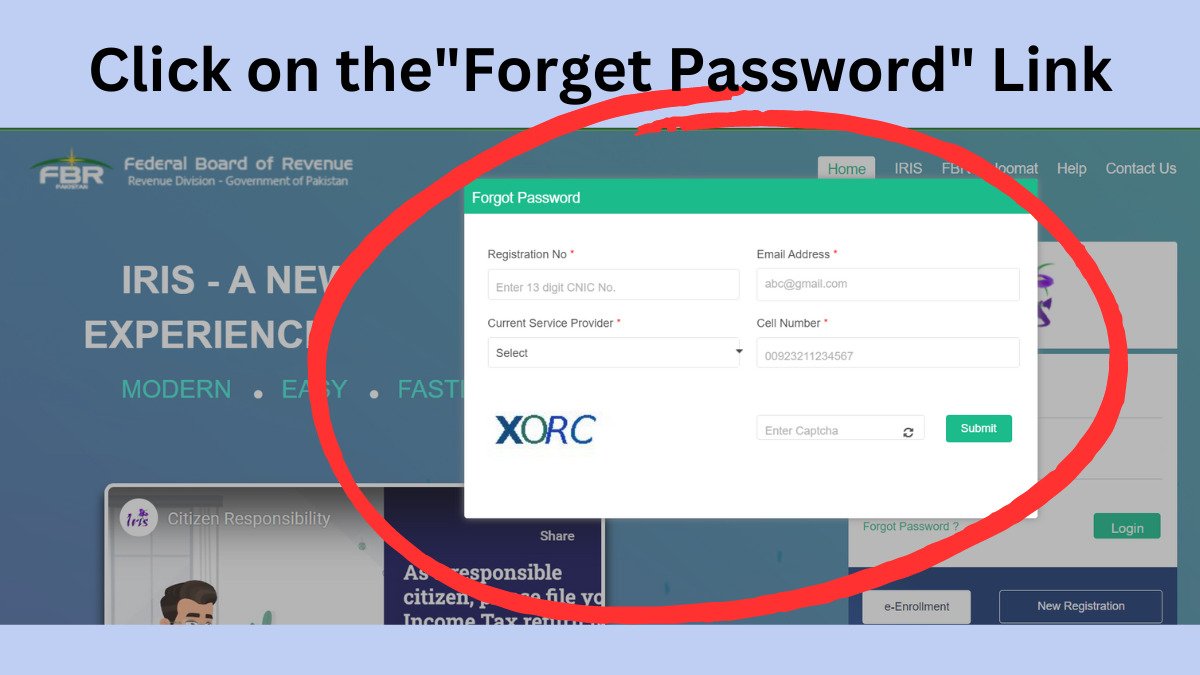

- Click on the “Forget Password” Link:

Now click on the "Forget Password" tab as provided in the middle of the page. It is available near "Sign In" on the right side.

- Enter Your Required Information on the “Forget Password” Form:

After you click on the "Forget Password" tab, you will see a form will open. Here you need to fill up all the required information they asked for to recover the password. Required information includes the registered Cell No, Email-ID, and Registration No (it may be CNIC No or NTN No in the case of a partnership business or a private limited company).

- Submit the Form

After you have provided all the required information and data now you need to submit the "Forget Password" form.

- Check your E-mail and Cell for a Recovery Code:

After you have submitted your "Forget Password" form verification codes will be forwarded by FBR to the registered e-mail and cell no of the applicant. Now, ask the taxpayer to provide you with both verification codes and then enter on required fields on the form. after filling out the form with both verification codes, now submit the form.

- If you do not receive verification codes:

If verification codes do not come on your cell then you need to send a message from your registered mobile. You need to send a message by writing "msg" on "9966". Moreover, soon after you send this message your cell verification code will come to your cell no. Moreover, if the verification code does not come in the e-mail then you are advised to check the "Junk" email tab for the verification code.

- Set a New Password of FBR Iris Portal of Taxpayer:

After verification codes have been entered and verified by the FBR. Now you need to enter and set a new password for the FBR Iris Portal. Moreover, keep your new password in this format: alphanumeric (e.g., 123456) and with lower and upper case letters (e.g., abcd). Along with special characters (e.g., #@$).

- Confirm the New Password:

Once you have set a new password now you need to verify that it's working. For this purpose sign up on the FBR Iris portal by using this password. Now you can provide it to its user for filing your tax return on time.