Tax on Agricultural Income in Pakistan 2022

Agricultural income is an exempt income from tax under section 41 of the Income Tax Ordinance, 2001. Such exemption from tax under ITO 2001 ( section 41 & section 111(1)(d) ), is available only when agriculture income is charged to tax under provincial law.

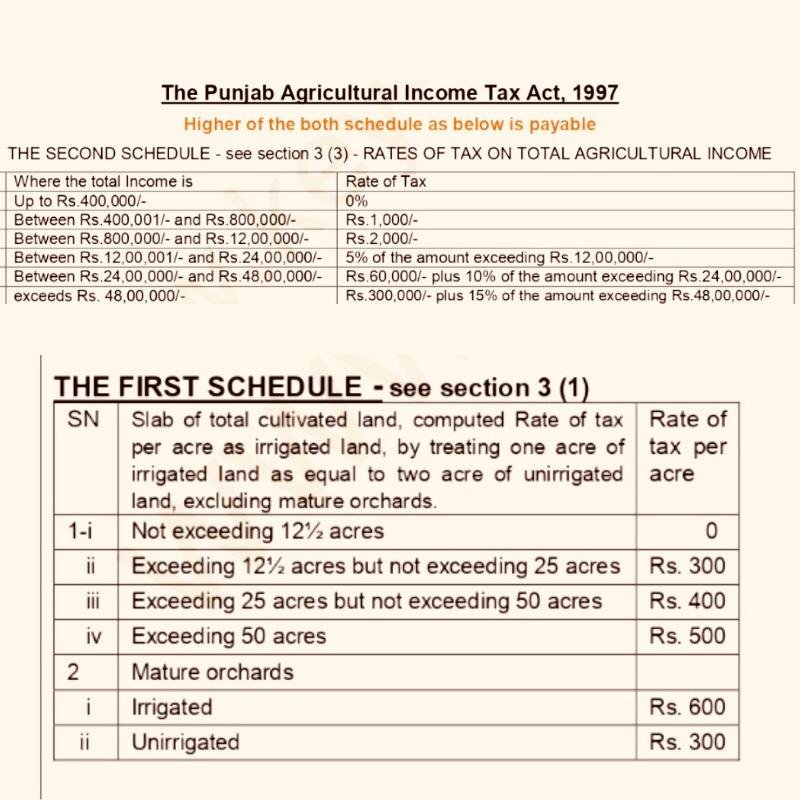

Tax on Agricultural Income in Pakistan 2022 (THE PUNJAB AGRICULTURAL INCOME TAX ACT 1997)

In Punjab, the taxation of agriculture income is administered under the provincial law of “The Agriculture Income Tax Act 1997“. Under such Act, Agriculture Income is taxed by any of the following two methods;

AREA or LAND BASED: Agriculture Income taxed based on acres.

INCOME BASED:

Agriculture income tax based on Income computed under clause 4 of the Act (as per schedule 2).

Tax Payable Basis: Whichever is higher.

The said ACT, also allows the taxpayers to pay such agriculture income tax through their agriculture income declared in ‘Income Tax Return’ (ITR) (as per schedule 2 –Income based).

Tax on the basis of income tax return ( 3B )

Notwithstanding the provisions of section 3, where any person has declared agricultural income for any assessment year in the return filed under the Income Tax Ordinance, 2001, the person shall pay the tax on such income at the rate specified in the Second Schedule.”

It is important here to mention that exemption was given by provincial revenue authority in relation to provincial tax payable on agriculture income as per Second Schedule (Income Based) in a meeting held on October 15, 2016. So, only Area / Land based agriculture income tax is applicable since then in Punjab.

Exemptions from Provincial Agriculture Income Tax

If area is below than 12.5 acres then area wise tax is also exempt. Agriculture Income is exempt up to 400,000, as per the Act “The Punjab Agricultural Income Tax Act 1997”.

“Agricultural Income” Definition under Income Tax Ordinance, 2001

(a) any rent or revenue derived by a person from land which is situated in Pakistan and is used for agricultural purposes;

(b) any income derived by a person from land situated in Pakistan from —

(i) agriculture;

(ii) the performance by a cultivator or receiver of rent-in-kind of any process ordinarily employed by such person to render the produce raised or received by the person fit to be taken to market; or

(iii) the sale by a cultivator or receiver of rent-in-kind of the produce raised or received by such person, in respect of which no process has been performed other than a process of the nature described in sub-clause (ii); or

(c) any income derived by a person from —

(i) any building owned and occupied by the receiver of the rent or revenue of any land described in clause (a) or (b);

(ii) any building occupied by the cultivator, or the receiver of rent-in-kind, of any land in respect of which, or the produce of which, any operation specified in sub-clauses (ii) or (iii) of clause (b) is carried on,

but only where the building is on, or in the immediate vicinity of the land and is a building which the receiver of the rent or revenue, or the cultivator, or the receiver of the rent-in-kind by reason of the person’s connection with the land, requires as a dwelling-house, a store-house, or other out-building.

Rate of tax on total agricultural income as per acre (Land / Area Based Rate of Tax)

THE FIRST SCHEDULE [SEE SECTION 3(1)]

Land-based or area based tax is assessed on the basis of the Cultivated Land Area. The rate of tax is based on the number of Acre as irrigated land. If the cultivated land is unirrigated then one acre of irrigated land is equal to two-acre of unirrigated land. Tax on unirrigated land is half of the irrigated land.

| S.No | Land / Area | Rate of Tax |

|---|---|---|

| 1 | 12.5 acres land ownership | No Tax |

| 2 | 12.5 acres to 25 acres | Rs.300 per acre |

| 3 | 26 acres to 50 acres | Rs.400 per acre |

| 4 | 50 acres or more | Rs.500 per acre |

| (2) Mature orchards | ||

| Irrigated | Rs 600 per acre | |

| Unirrigated | Rs 300 per acre |

Note: Slab of total cultivated land, computed Rate of tax per acre as irrigated land, by treating one acre of irrigated land as equal to two acre of unirrigated land, excluding mature orchards.

Mature Orchard” means orchard of the age of seven years or more in the case of mango orchard and of the age of five years or more in the case of other orchards;

RATES OF TAX ON TOTAL AGRICULTURAL INCOME

THE SECOND SCHEDULE [SEE SECTION 3(3)]

Under The Punjab Agriculture Income Tax Act 1997, Agriculture Income consists of any rent, revenue or income derived from land which is situated in Punjab and is used for agricultural purposes as reduced by permissible allowances and deductions. Taxable agriculture income of a person for the tax year will be calculated as below:

| S.NO | Agriculture Income Slab | Tax Rate (%) |

|---|---|---|

| 1 | If total income does not exceed Rs.400,000/= | 0% |

| 2 | If total income is more than Rs.400,000 but does not exceed Rs.800,000/= | Rs.1,000 |

| 3 | If total income is more than Rs.800,000 but does not exceed Rs.1,200,000/= | Rs.2,000 |

| If total income is more than Rs.1,200,000 but does not exceed Rs.2,400,000/= | 5% of the amount exceeding Rs 1,200,000 | |

| If total income is more than Rs.2,400,000 but does not exceed Rs.4,800,000/= | Rs 60,000 plus 10% of the amount exceeding Rs 2,400,000 | |

| 4 | If total income is more than Rs.4,800,000/= | Rs 300,000 plus 15% of the amount exceeding Rs 4,800,000 |

Authority to Collection of Tax

Tax on Agriculture Income is assessed and collected by the Collector of district. Who is Appointed under The Punjab Land Revenue Act 1967. In case a person is holding land in more than one patwar circle, the owner shall file a statement regarding the location of his land in the Punjab.

Allowances and Deductions allowed against Agriculture Income:

(a) any expenditure on account of labour for–

(i) tilling the land;

(ii) sowing the seed;

(iii) ploughing/planting;

(iv) tending/pruning;

(v) rendering the produce fit to be taken to market;

(vi) any other agricultural operation;

(b) any expenditure incurred on purchase of–

(i) seed;

(ii) fertilizers and pesticides;

(c) any expenditure incurred on–

(i) hiring animals, tractors, agricultural machinery and implements used for earning agricultural income;

(ii) repair and maintenance of water-courses;

(d) any expenditure incurred on–

(i) harvesting of agricultural produce;

(ii) marketing of the agricultural produce;

(e) any sum paid on account of–

(i) ushr;

(ii) local cess and other cesses;

(iii) water-rate (Abiana);

(iv) electricity bills in respect of tubewells and lift pumps used for agriculture;

(v) fuel charges in respect of tubewells and lift pumps uses for agriculture;

(vi) rent of land used for agriculture;

(vii) obtaining of agricultural loans;

(viii) mark-up on agricultural loans;

(f) in respect of depreciation of such buildings, machinery and plant being the property of the assessee used for the purpose of earning agricultural income, allowance at the rate of 15 percent of the written down value; and

(g) any other expenditure not being in the nature of capital expenditure or personal expenses of the assessee laid out or expended wholly and exclusively for the purposes of agriculture.

RELATED KEY WORDS

agriculture income tax calculator | income tax on livestock in Pakistan

agriculture tax rate | agriculture income tax in Pakistan pdf

tax on purchase of agricultural land in Pakistan | agriculture income tax ordinance, 2001

agriculture income tax challan form | total agriculture income during

income during the tax years | income tax ordinance 2001 |

tax years amounting to rs