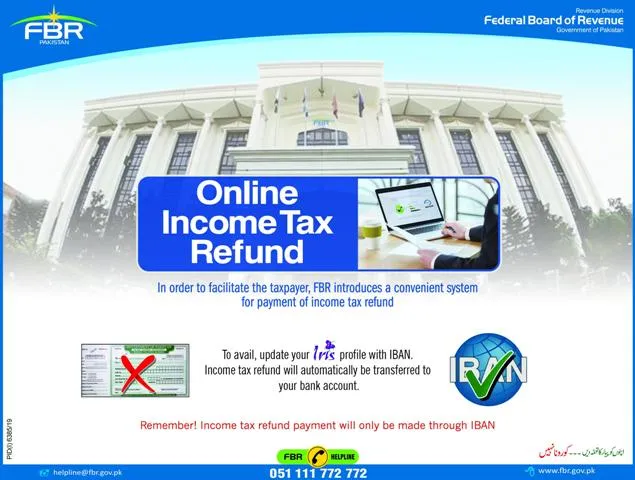

Federal Board of Revenue (FBR) ceased manual processing of income tax refunds. FBR ordered regional tax offices that process the tax refunds at central level through State Bank of Pakistan (SBP).

An office order to all chief commissioners of Large Taxpayers Offices (LTOs), Medium Taxpayers Offices (MTOs), Corporate Tax Offices (CTOs) and Regional Tax Offices (RTOs).

The FBR said, “Field formations should send refund lists as and when asked by the FBR on given format and instructions,”

The FBR instructed to Commissioners Inland Revenue to ensure application of order. Implementation under Section 170(4) of the Income Tax Ordinance, 2001.

Refunds.— Section 170(4) “The Commissioner shall, within [sixty] days of receipt of a refund application under sub-section (1), serve on the person applying for the refund an order in writing of the decision [after providing the taxpayer an opportunity of being heard].“

The responsibility of examination of income tax refund orders are with field formations. FBR further clarified, that “Henceforth, no manual income tax refunds will be processed. Therefore, Chief Commissioners-IR are required to keep all voucher books in safe custody.”

Refund cases where court / FTO recommendations are in field these may be sent separately for processing.