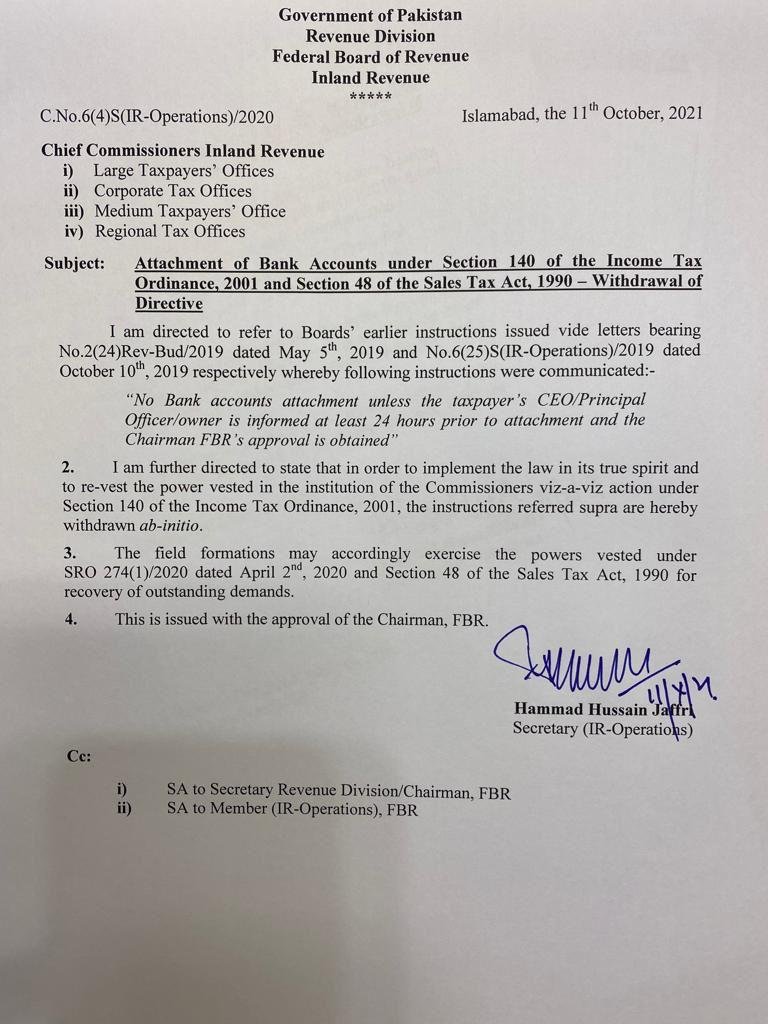

The Federal Board of Revenue (FBR) has issued office directive to allow the field formations to freeze the bank accounts of taxpayers without any prior approval of the Chairman FBR and without 24 hours prior intimation to the CEOs / principal officers or owners of businesses.

FBR on Monday directed the field formations with regard to the withdrawal of directives pertaining to informing the taxpayer before attaching the bank accounts under Section 140 of the Income Tax Ordinance, 2001 and Section 48 of the Sales Tax Act, 1990.

The FBR had issued the directions pertaining to informing the taxpayer CEOs / principal officers / owners at least 24 hours prior to the attachment of bank accounts.

In order to implement the law in letter and spirit the to re-vest the power vested in the institution of the commissioner’s viz-a-viz action under Section 140 of the Income Tax Ordinance, 2001, the instructions with regard to the attachment of bank accounts and the Chairman FBR approval are withdrawn.

The field formations will accordingly exercise the powers vested under SRO 274(1)/2020 dated April 2, 2020, and Section 48 of the Sales Tax Act, 1990 for recovery of outstanding demand.

Shabbar Zaidi tweet about FBR’s this Directive

When Shabbar Zaidi joined FBR as Chairman, then it was his first step to give all powers of freezing of bank accounts to Chairman, FBR. Which has now withdrawn by Federal Board of Revenue (FBR).

He said, “My first instructions as Chairman FBR on no freezing of bank accounts in 2019, withdrawn yesterday relate to decency & etiquette in tax culture. It was totally legal. Commissioner’s right are not snatched. Decency & trust requires confidence between tax payers and tax collectors.“