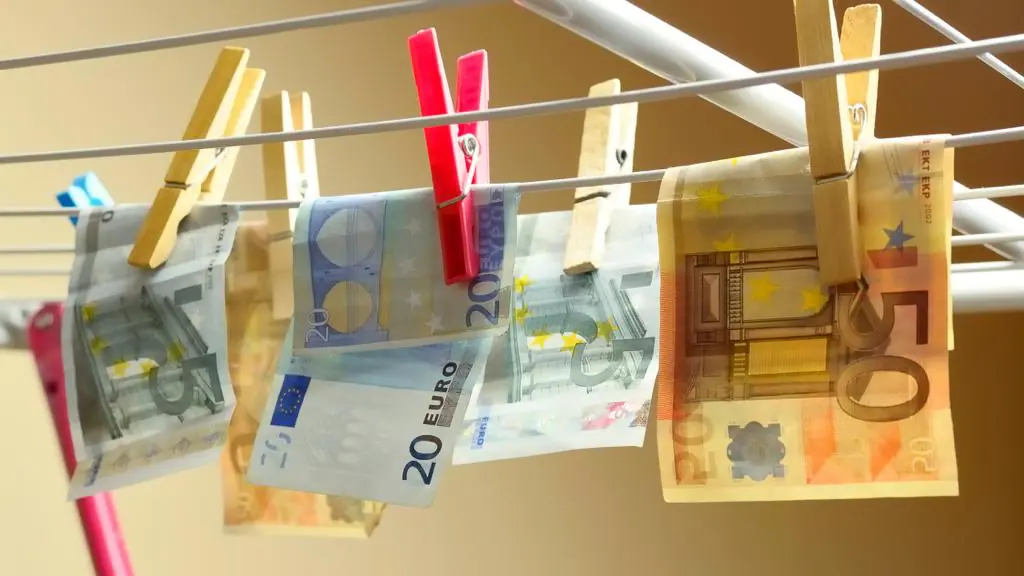

The Federal Board of Revenue (FBR) has intensified offsite and onsite inspections against Designated Non-Financial Businesses and Professions (DNFBPs) and imposed penalties on a large number of real estate agents for not implementing anti-money laundering and counter finance terrorism regime, Dawn Newspaper reported.

The FBR designated Department of Director General DNFBPs imposed heavy fines on all those real agents who were not registering themselves with the Federal Board of Revenue (FBR), which is a requirement in compliance with Financial Action Task Force (FATF).

The Federal Board of Revenue (FBR) has completed actions on DNFBPs in the FATF action plan in just one reporting cycle and one year ahead of the deadlines in September 2022.

The DNFBPs include: real estate agents, precious stone dealers, Lawyers, notaries, other independent legal professionals and accountants.

The FBR has simplified the rules to make it easier for DNFBPs to implement it. It has also made a customised mobile app for the registration by DNFBPs, screening the lists of designated persons and generating Suspicious Transaction Reports (SRTs).

In June, the FATF plenary had approved seven new action plans for Pakistan, focusing on combating money laundering. This plan contains two actions specific to DNFBPs, in particular, the real estate agents and Dealers in Precious Metals and Stones (DMPS).

The FBR was already designated as AML/CFT regulatory authority for real estate agents, DPMS and accountants other than those registered with ICAP and ICMAP under the Anti-Money Laundering Act 2010, through amendments made in September 2020.

Since the designation of FBR as the AML/CFT regulatory authority, it has issued AML/CFT regulations for its regulated entities and also educated and facilitated the DNFBPs on implementation of the new AML/CFT regime.

A portal was made available on FBR website, which contains complete guidance documents and other information for the DNFBPs. A detailed supervisory plan was chalked out for offsite and onsite supervision of the DNFBPs.

Since June, the FBR has taken inspections of a large number of DNFBPs and imposed a wide range of penalties on the delinquent entities. The real estate associations were also taken on board for implementation of the AML/CFT obligations.