The Federal Board of Revenue (FBR) has extended the deadline for implementing the revised FBR Property valuation rates 2022 of properties in 40 major urban cities by holding its notification in abeyance till January 31, 2022.

Minister for Finance Shaukat Tarin and FBR high-ups are considering that the valuation rates of properties should be revised upward in the range of 25 to 50 percent in accordance with the Statutory Regulatory Order (SRO) issued by the board in 2019.

However, nothing has been finalized so far because under the World Bank (WB) conditions, it is one of the conditions of $400 million Pakistan Raises Revenues (PRR) that the valuation rates of real estate would be brought close to the real market values.

Minister for Finance Shaukat Tarin remained busy in finalising the mini-budget and getting approval from Parliament, so the valuation rates for the real estate sector could not be finalised.

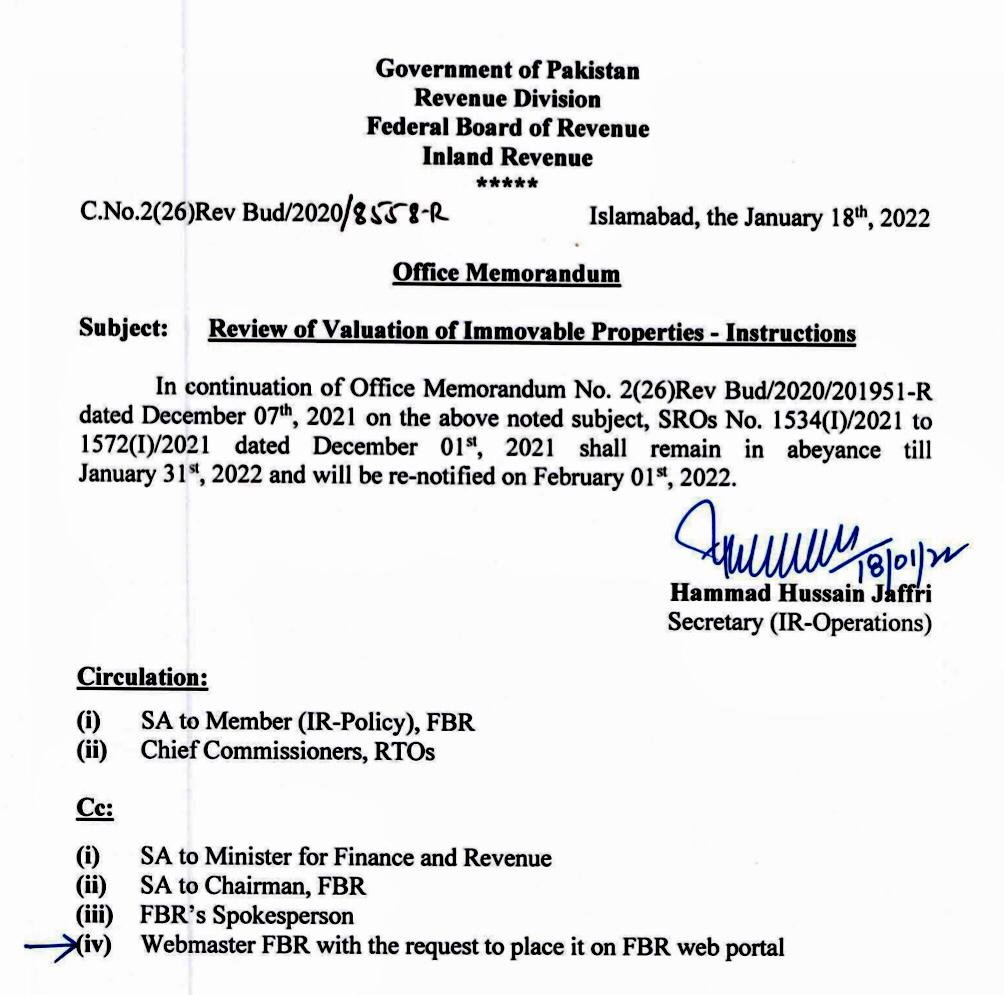

Tarin was expected to take up this issue on January 18, 2022, for holding consultations with the FBR and relevant stakeholders but he was not feeling well on Tuesday. So all his engagements got cancelled and the meeting on the valuation rate of properties could not take place. In the meanwhile, the FBR issued a fresh Office Memorandum on January 18, 2022, for extending the deadline on implementing the revised valuation rates in abeyance till January 31, 2022. Now the new valuation rates would be notified on February 1, 2022.

It was a very awkward situation that in the last two working days on Monday and Tuesday, no transaction could take place all over the country, especially in 40 major urban cities, because the revised notification of valuation of properties had become effective whereby the rates had gone up to 700 percent. The notification, which was put in abeyance till January 16, 2022, had become effective on January 17 and 18, 2022.

The FBR had jacked up the valuation rates in 40 different cities up to 700 percent through official notification issued on December 1, 2021 that resulted in hue and cry in all over the country. Then the FBR took the decision to put the revised valuation in abeyance till January 16, 2022, as all the chief commissioners were instructed to constitute the Valuation Review Committee (VRC) and revise the valuation rates in consultation with the concerned stakeholders. Through the Official Memorandum, the revised valuation rates were placed in abeyance till January 16, 2022.

Now the deadline has already expired, so the FBR issued a fresh notification on January 18, 2022, stating that the notification will remain in abeyance till January 31, 2022 and will be re-notified on February 01, 2022.