FBR ASSETS & TAX DEDUCTIONS INQUIRY SYSTEM

The FBR Assets Inquiry or FBR Maloomat portal allows citizens of Pakistan to access information about their assets and Tax payment activities without any hassle. The information on this portal can be accessed free of charge. However, you will be required to register your account on the FBR Iris Maloomat portal by using a system-generated code on your cell / mobile number.

You can use this FBR Iris Maloomat portal to check your asset details online regardless of where you live.

WHO CAN CHECK THEIR ASSET INFORMATION?

Here are some conditions you must fulfil in order to check your assets using FBR:

- You must be 18 years of age

- You must have a valid CNIC or NICOP

- A mobile phone number registered with the PTA in the name of taxpayer.

HOW TO INQUIRE THE ASSETS & TAX DEDUCTIONS DETAILS VIA FBR MALOOMAT PORTAL

Here is a step-by-step tutorial on how to carry out an FBR assets check using the FBR’s Maloomat portal.

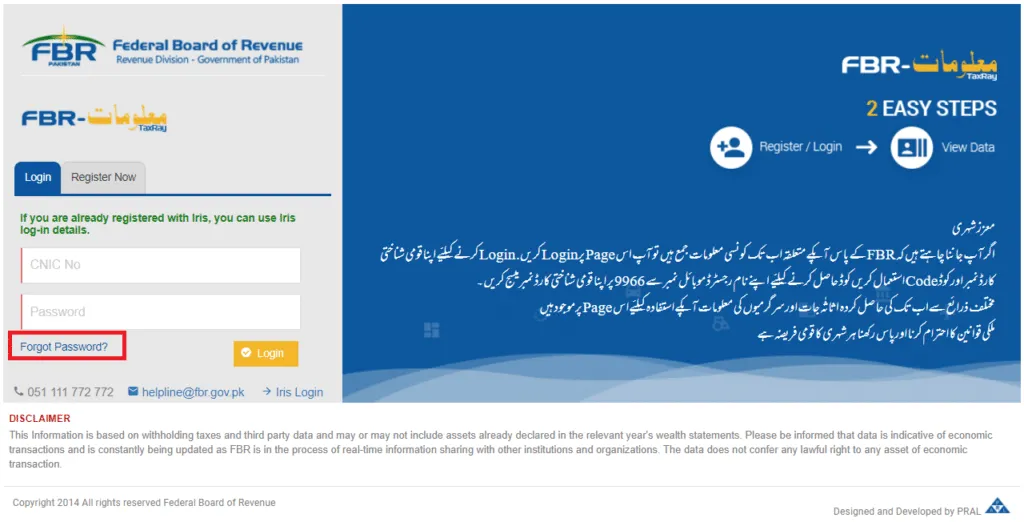

- 1st Step:Visit the official website forFBR Maloomat

- 2nd Step:Use your password and login to access the portal (if registered already with FBR)

- 3rd Step: Or, Select the ‘Get Login / Password for Asset Inquiry (It’s Free)’ tab appearing on the top. Then, enter your CNIC number, name, choose an appropriate prefix, pick current service provider and add your mobile number in the relevant fields. Just make sure the phone number you enter into the portal must be registered in your name.

- 4th Step:You will Receive the code on your mobile number

- 5th Step: Enter the code and Submit

- 6th Step: Now, You will receive FBR Iris Password and Pin code.

- 7th Step:Once you get the login details, now login to the FBR Maloomat system by using the above FBR Password.

- 8th Step: Now, you will be able to see different tabs. From there, select any tab and click on ‘Load Data’ to see your relevant data. You can view the following information if you check your assets using FBR Maloomat Portal:

- Withholding Tax

- Vehicles

- Travel information

- Utilities with bill amount

- The details of properties on your name

Please note that FBR updates the assets data on its portal on a regular basis. Therefore, you will be required to visit the portal regularly to view the updated data.