IT Exporters Facing Issue in Filing Income Tax Returns | Section 154A @1%

IT Exporters Facing Issue in Filing Income Tax Returns | Section 154A @1%.A lot of taxpayers are complaining now a days that tax liability undersection 154A @1% on Export of Servicesis not taking effect in the computation tab of the income tax return form for the tax year 2022.

According to tax practitioners and IT exporters: we are facing an issue when we enter foreign income proceeds amount and tax @ 1% on export services under section 154A, in the final tax tab then its impact is not updated in the tax computation of the income tax return form for the tax year 2022.

It is taking advance tax deducted but the liability portion not taking due to which short deduction does not include in tax liability chargeable and tax deducted under section 154A @1% fall in income tax refundable. In another case where no tax is deducted under this 1% no tax liability is showing in the tax computation. Moreover, other tax liabilities under sections 151, and 37, on bank profit, and gain on sale of immovable assets, etc., are working properly.

FBR HELPLINE

Taxpayers have sent emails to the FBR helpline and registered their complaints on the helpline. You may also contact FBR on these:

FBRHelpline Number:National:051 111 772 772International:0092 51 111 772 772

FBR Email Address: is Email:helpline@fbr.gov.pk. Moreover, we also remind here that the last date to file annual income tax returns for salaried, individuals, and AOP taxpayers is December 15. 2022. According to FBR, no further extension in date will be allowed in filing tax returns.

Moreover, IT exporters and tax practitioners also contacted the FBR helpline and according to them, they are working on this error to remove.

READ ALSO: What is Section 154A 1% Tax on IT Export Services

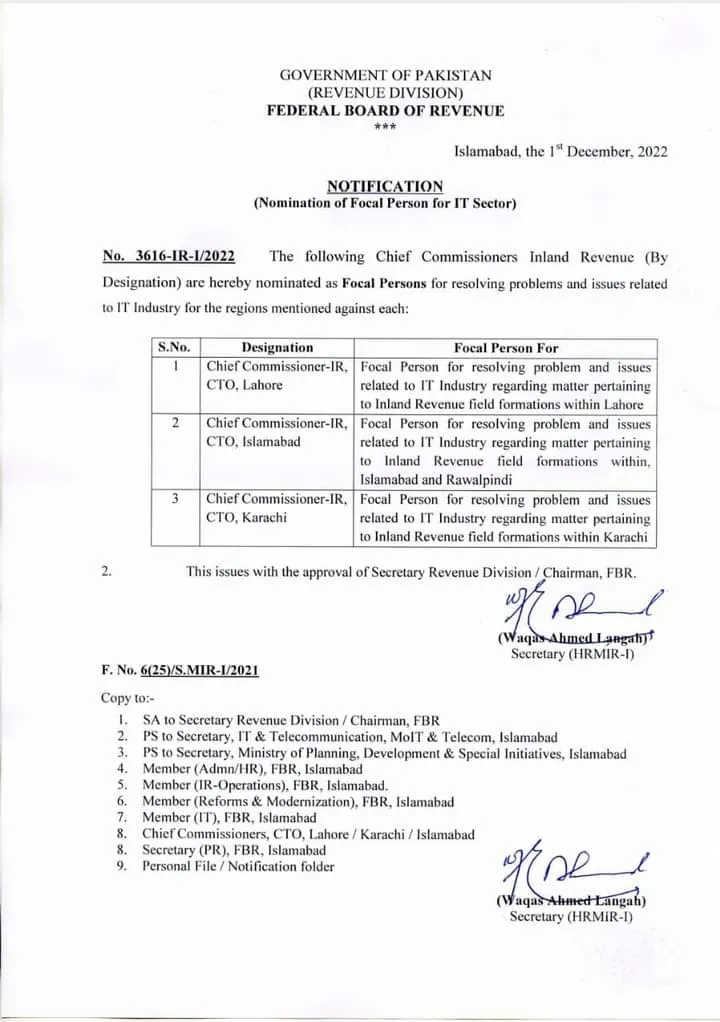

Focal Persons appointed by FBR for IT Industry

Moreover, For resolving issues related to IT industry, FBR has nominated focal persons for Karachi, Lahore and Islamabad regions.