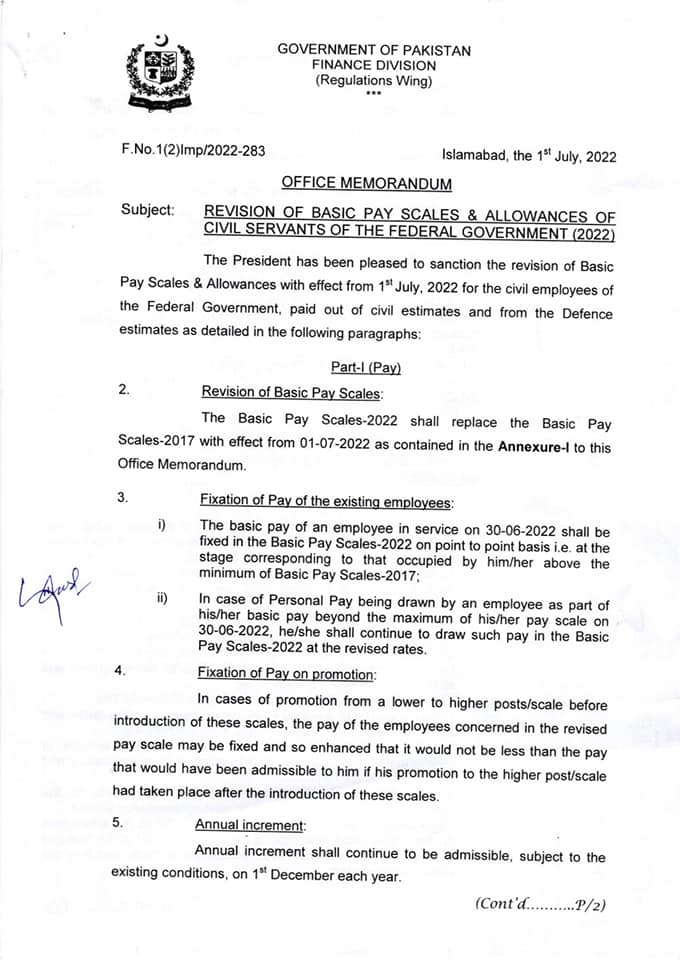

Latest Pay Scale Chart 2022-23 | Notification of Salary Increase 2022.

Government of Pakistan Finance Division (Regulation Wing) issued Notification regarding revised basic Pay Scales 2022-23 and Allowances on 01-07-2022.

Further, Federal Government has merged five adhoc relief allowances 2016, 2017, 2018, 2019 and 2021 into basic pay and introduced Basic Pay Scales 2022.

However, Federal Government previously revised pay scales in 2017. Now in 2022 after about five years Federal Government again revised it. The details of which are as under:

Notification of Revised Basic Pay Scales 2022 and Allowances Federal

Moreover, President has been pleased to sanction the revision of Basic pay Scales & Allowances with effect from 1st July, 2022 for the civil employees of the Federal Government. As detailed are in the following paragraphs:-

Part-I(Pay)

Revision of Basic Pay Scales:

The Basic Pay Scales-2022 shall replace the Basic Pay Scales of 2017 with effect from July 1 2022 as contained in Annexure-I to this Office Memorandum.

Fixation of Pay of the existing employees:

i) the basic pay of an employee in service on 30-06-2022 shall be fixed in the Basic Pay Scales-2022 on point to point basis i.e. at the stage corresponding to that occupied by him/her pay scale on 30-06-2022, he/she shall continue to draw such pay in the Basic pay Scales-2022 at the revised rates.

Fixation of Pay on Promotion:

In cases of Promotion from a lower to higher posts/scale before the introduction of these scales, the pay of the employees concerned in the revised pay scale may be fixed and so enhanced that it would not be less than the pay that would have been admissible to him if his promotion to the higher post/scale had taken place after the introduction of these scales.

Annual increment:

Annual increment shall continue to be admissible, subject to the existing conditions, on 1st December each year.

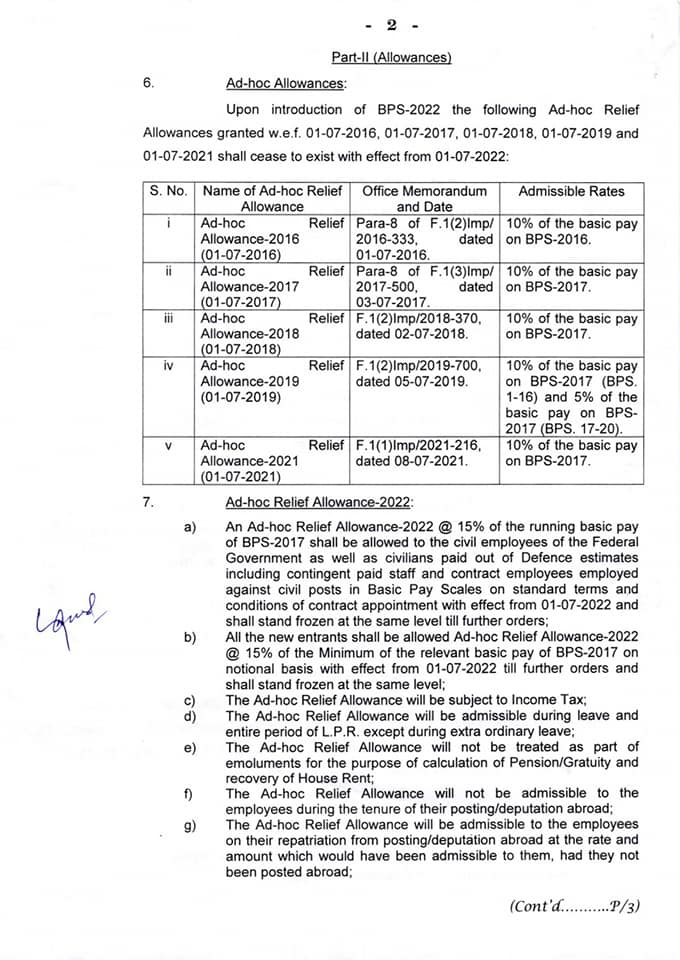

Part-II Allowances

Ad-hoc Allowances:

On introduction of BPS-2022 the following ad-hoc Relief Allowance granted w.e.f. 01-07-2016, 01-07-2017, 01-07-2018, 01-07-2019 and 01-07-2021 shall cease to exist with effect from 01-07-2022:

| S.No. | Name of Ad-hoc Relief Allowance | Office MemorandumAnd Date | Admissible Rates |

| i. | Ad hoc Relief Allowance 2016 (01-07-2016) | Para-8 of F.1(2)Imp/2016-333, dated01-07-2016 | 10% of the basic pay on BPS-2016. |

| ii. | Ad-hoc Relief Allowance-2017(01-07-2017) | Para-8 of F.1(3)Imp/2017-500, dated03-07-2017 | 10% of the basic pay on BPS-2017. |

| iii. | Ad-hoc Relief Allowance-2018(01-07-2018) | F.1(2)Imp/2018-370, dated02-07-2018 | 10% of the basic pay on BPS-2017. |

| iv. | Ad-hoc Relief Allowance-2019(01-07-2019) | F.1(2)Imp/2019-700, dated05-07-2019 | 10% of the basic pay on BPS-2017.(BPS.1-16) and 5% of the basic pay on BPS-2017 (BPS. 17-20). |

| v. | Ad-hoc Relief Allowance-2021(01-07-2021) | F.1(1)Imp/2021-216, dated08-07-2021 | 10% of the basic pay on BPS-2017. |

Ad-hoc Relief Allowance-2022:

a) An Ad-hoc Relief Allowance-2022 @ 15% of the running basic pay of BPS-2017 shall be allowed to the civil employees of the Federal Government as well as civilians paid out of Defence estimates including contingent paid staff and contract employees employed against civil posts in Basic Pay scales on standard terms and conditions of contract appointment with effect from 01-07-2022 and shall stand frozen at the same level till further orders.

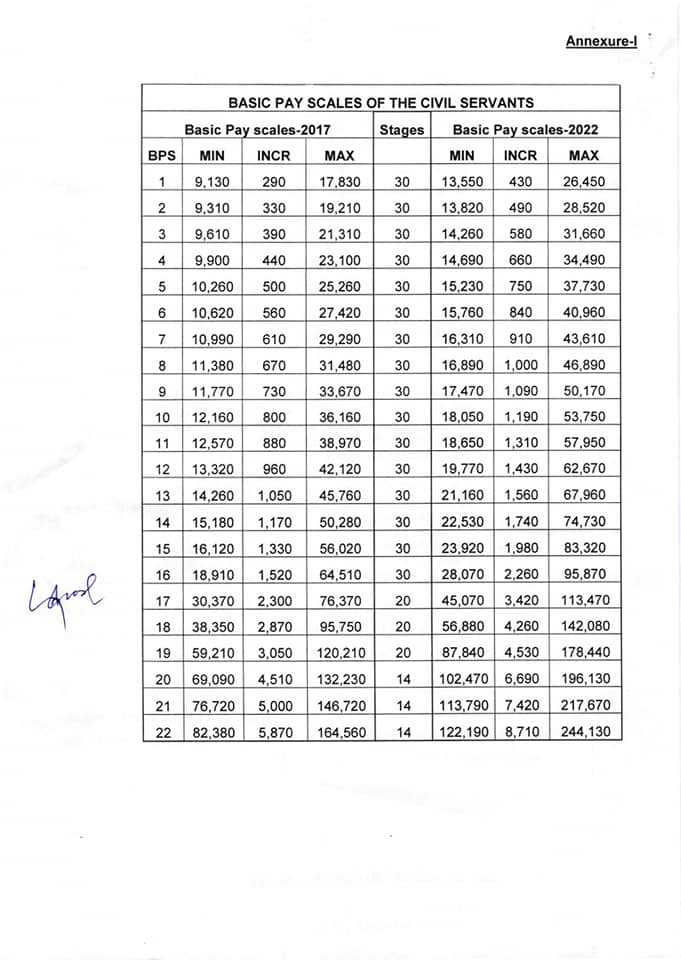

Final Revised Basic Pay Scales 2022 Initial, Final Stages, and Increment

| 2017 Pay Scales | 2022 Pay Scales | |||||

| BPS | Initial Stage | Increment | Last Stage | Initial Stage | Increment | Last Stage |

| BPS-01 | 9130 | 290 | 17830 | 13550 | 430 | 26450 |

| BPS-02 | 9310 | 330 | 19210 | 13820 | 490 | 28520 |

| BPS-03 | 9610 | 390 | 21310 | 14260 | 580 | 31660 |

| BPS-04 | 9900 | 440 | 23100 | 14690 | 660 | 34490 |

| BPS-05 | 10260 | 500 | 25260 | 15230 | 750 | 37730 |

| BPS-06 | 10620 | 560 | 27420 | 15760 | 840 | 40960 |

| BPS-07 | 10990 | 610 | 29290 | 16310 | 910 | 43610 |

| BPS-08 | 11380 | 670 | 31480 | 16890 | 1000 | 46890 |

| BPS-09 | 11770 | 730 | 33670 | 17470 | 1090 | 50170 |

| BPS-10 | 12160 | 800 | 36160 | 18050 | 1190 | 53750 |

| BPS-11 | 12570 | 880 | 38970 | 18650 | 1310 | 57950 |

| BPS-12 | 13320 | 960 | 42120 | 19770 | 1430 | 62670 |

| BPS-13 | 14260 | 1050 | 45760 | 21160 | 1560 | 67960 |

| BPS-14 | 15180 | 1170 | 50280 | 22530 | 1740 | 74730 |

| BPS-15 | 16120 | 1330 | 56020 | 23920 | 1980 | 83320 |

| BPS-16 | 18910 | 1520 | 64510 | 28070 | 2260 | 95870 |

| BPS-17 | 30370 | 2300 | 76370 | 45070 | 3420 | 113470 |

| BPS-18 | 38350 | 2870 | 95750 | 56880 | 4260 | 142080 |

| BPS-19 | 59210 | 3050 | 120210 | 87840 | 4530 | 178440 |

| BPS-20 | 69090 | 4510 | 132230 | 102470 | 6690 | 196130 |

| BPS-21 | 76720 | 5000 | 146720 | 113790 | 7420 | 217670 |

| BPS-22 | 82380 | 5870 | 164560 | 122190 | 8710 | 244130 |

Budget 2022-23 Pakistan Salary Increase | Finance Act 2023 | Finance Bill 2022-23 Pakistan |

Finance Bill 2022 | Pay Scale Chart 2021-22 pdf | Budget 2022-23 Approved |

Salary Increase Notification 2022 | Finance Act 2022 |

Revised Pay Scales 2022-23. Budget 2022-23 Pakistan Salary Increase.

Latest Pay Scale Chart 2022-23 | Notification of Salary Increase 2022

please E-mail me the this notification of revived pay scale chart 2022

please E-mail me the notification of revised pay scale chart 2022.