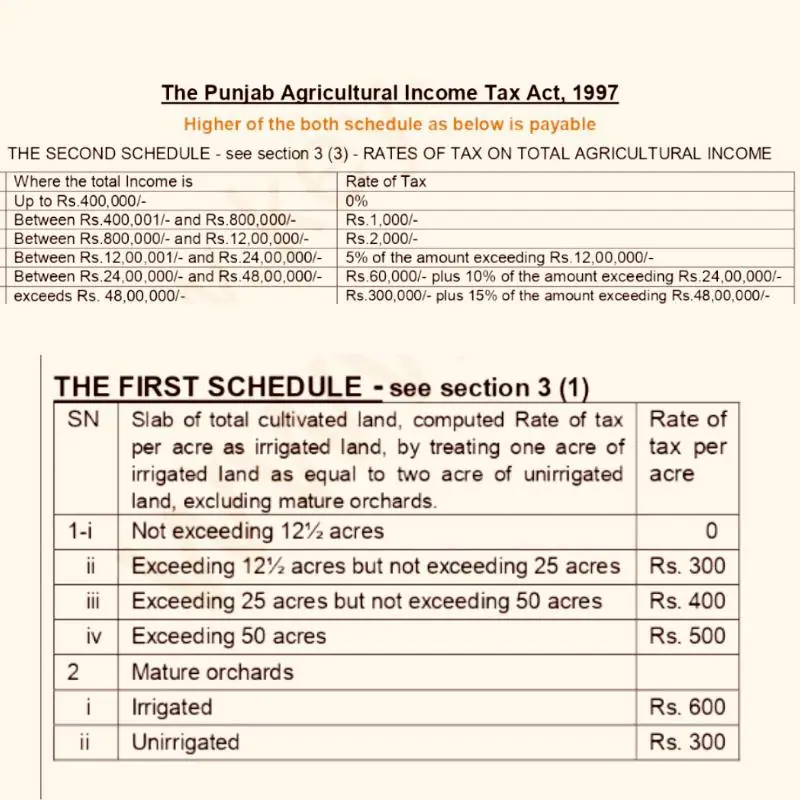

Agriculture Income tax Rate in Punjab Pakistan in year 2020-2021 on total agricultural income as per acre; THE FIRST SCHEDULE [SEE SECTION 3(1)]

Land-based or area based tax is assessed on the basis of the Cultivated Land Area. The rate of tax is based on the number of Acre as irrigated land. If the cultivated land is unirrigated then one acre of irrigated land is equal to two-acre of unirrigated land. Tax on unirrigated land is half of the irrigated land.

Agriculture Income Tax Rate in Pakistan year 2020-2021 – Area wise

| S.No | Land / Area | Rate of Tax |

|---|---|---|

| 1 | 12.5 acres land ownership | No Tax |

| 2 | 12.5 acres to 25 acres | Rs.300 per acre |

| 3 | 26 acres to 50 acres | Rs.400 per acre |

| 4 | 50 acres or more | Rs.500 per acre |

| (2) Mature orchards | ||

| Irrigated | Rs 600 per acre | |

| Unirrigated | Rs 300 per acre |

Note: Slab of total cultivated land, computed Rate of tax per acre as irrigated land, by treating one acre of irrigated land as equal to two acre of unirrigated land, excluding mature orchards.

What is matured orchard ?

Mature Orchard” means orchard of the age of seven years or more in the case of mango orchard and of the age of five years or more in the case of other orchards;

ALSO READ: Tax on Agricultural Income in Pakistan

Agriculture Income Tax Rates in Punjab Pakistan in year 2020-2021 ON TOTAL AGRICULTURAL INCOME – THE SECOND SCHEDULE [SEE SECTION 3(3)]

Under The Punjab Agriculture Income Tax Act 1997, Agriculture Income consists of any rent, revenue or income derived from land which is situated in Punjab and is used for agricultural purposes as reduced by permissible allowances and deductions. Taxable agriculture income of a person for the tax year will be calculated as below:

Agriculture Income Tax Rate in Pakistan year 2020-2021 – Agriculture Income Basis

| S.NO | Agriculture Income Slab | Tax Rate (%) |

|---|---|---|

| 1 | If total income does not exceed Rs.400,000/= | 0% |

| 2 | If total income is more than Rs.400,000 but does not exceed Rs.800,000/= | Rs.1,000 |

| 3 | If total income is more than Rs.800,000 but does not exceed Rs.1,200,000/= | Rs.2,000 |

| If total income is more than Rs.1,200,000 but does not exceed Rs.2,400,000/= | 5% of the amount exceeding Rs 1,200,000 | |

| If total income is more than Rs.2,400,000 but does not exceed Rs.4,800,000/= | Rs 60,000 plus 10% of the amount exceeding Rs 2,400,000 | |

| 4 | If total income is more than Rs.4,800,000/= | Rs 300,000 plus 15% of the amount exceeding Rs 4,800,000 |

Agriculture income tax rate in Pakistan 2021 | Agriculture income tax rate in Pakistan 2020 | Tax on agricultural income in Pakistan 2020 | FBR tax on agriculture income | Punjab agriculture income tax | Agriculture tax rate | Agriculture income tax rate in Pakistan 2020-21 | Agriculture income tax rate in Pakistan 2019-20 | Agri income tax rate Punjab | Tax on agricultural income in Pakistan 2021 | Agriculture tax in Pakistan 2020 | Punjab agriculture income tax 2020 |