Iris 2.0 Tax Filing System Launched by FBR

Iris 2.0 Tax Filing System Launched by FBR. Pioneer tax authority in Pakistan, Federal Board of Revenue has recently launched new tax filing system named Iris 2.0. FBR has launched it on Thursday 27th July 2023 here at FBR Head quarter Islamabad.

This new tax filing system has been developed by Pakistan Revenue Automation Limited (PRAL). As per FBR it will improve user experience as well as will increase the efficiency as compare to previous iris system. Tax authority also claimed that it will also be a cost saving tax filing system.

Features of New Upgraded Version of iris

Following are some features of iris 2.0 tax filing system:

- User satisfaction

- saving in usage of costly hardware requirements during peak loads

- backend enhancements

- new frontend design

- flawless experience for both users and the FBR

- major reduction in hardware expenditures

- improved user experience

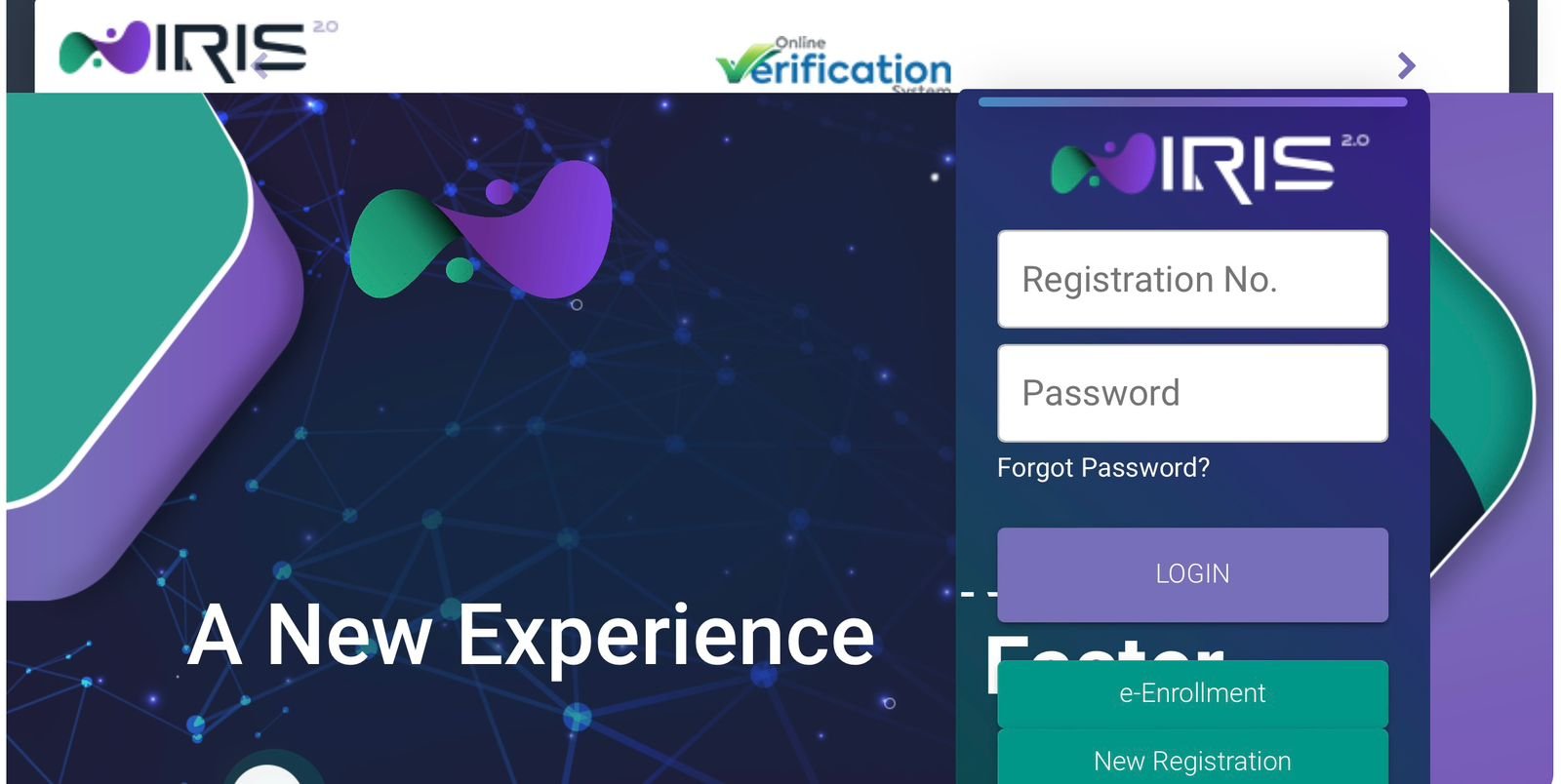

What is Iris Tax Filing System?

Tax filing software called “IRIS” used by the Federal Board of Revenue (FBR) in Pakistan. IRIS stands for “Integrated Risk Information System.” It’s online portal where:

- online tax returns are submitted,

- reply to tax notices regarding tax assessments and audits are submitted online

- filing monthly sales tax returns

- submission of appeal to commissioner appeals

- Request for grant of stay against appeal filed

- request for correction of tax challans paid

- registration of sales tax

- modification of income tax registration or NTN (addition of business name, change in particulars)

- filing request for exemption certificates

- registration of DNFBPs

- Revisions of tax returns and many more

This IRIS software is used by individuals and businesses in Pakistan for tax-related purposes. Purposes include filing income tax returns, tax compliance, and communication between taxpayers and FBR.

Challenges faced by taxpayers

The previous FBR’s IRIS tax filing system used by the Federal Board of Revenue (FBR) in Pakistan faced some challenges that taxpayers faced. There are some common issues reported were:

- Technical issues: Taxpayers experienced technical issues like, slow response times, server errors, and frequent downtimes during peak tax filing periods.

- User Interface: The user interface of the IRIS software was complex and lack of user-friendly. Which made it difficult for some taxpayers to complete their tax-related activities.

- Data Accuracy: There were sometime errors in tax calculations and filing.

- Connectivity Problems: Taxpayers faced challenges in accessing the online system effectively during peak periods.

- Lack of Training: Taxpayers struggled to get knowledge about the IRIS system due to lack of proper training.

- Security Concerns: As iris filing system is dealing with sensitive financial information. That’s why security concerns pointed out about the safety of the taxpayers’ data and financial transactions.

Hopefully with the launch of iris 2.0 by the FBR the previous issues will no more faced by taxpayers.

Key features of IRIS technology

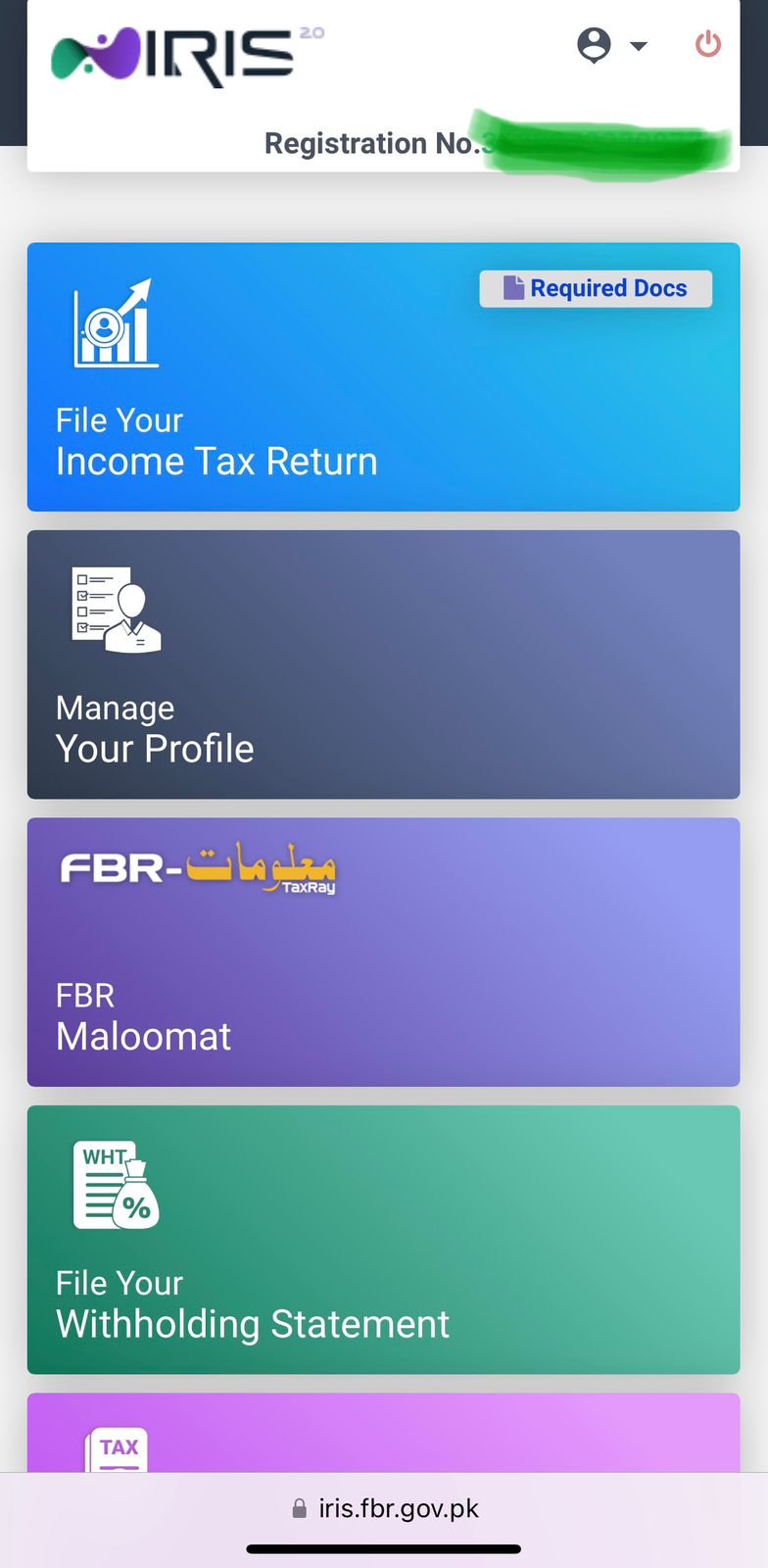

Iris tax management system offers:

- Online Tax Filing System: Taxpayers can submit their annual income tax returns and other tax-related compliances online through this IRIS system.

- Tax Information: Taxpayers can reach out their tax-related information, which include, tax assessments, tax payment history, via this online portal.

- Communication between taxpayers and FBR: This iris system enables taxpayers to communicate with the FBR about tax-related issues and problems.

- Data Integration: This IRIS filing system integrates taxpayer data from various sources. It makes easy for tax authorities to handle information properly.

- Automation: The iris system automates certain tax activities and efficiency in tax administration.

- Better User interface: Iris system provides better and user friendly interface.

New upgraded Iris 2.0 will hopefully do more than that which currently taxpayers are using.