Weekly Tax Updates from 3rd January to January 09 2021. World taxes, Top Tax News & Updates. Business & Industry…

A person who is liable to get registration of sales tax, if he fails to get sales tax registration shall…

SBP going to launch a new digital payment system ‘RAAST’ from next week. The State Bank of Pakistan (SBP) is…

Taxation of Builders and Developers. There is a complete package covering tax impact from all aspects. Taxpayer is eligible to…

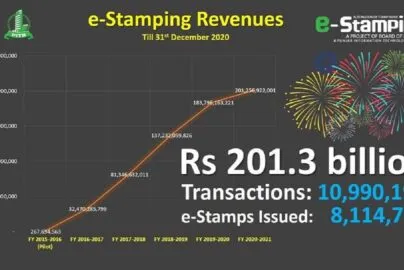

E-Stamping, a flagship project of the Punjab Information Technology Board (PITB), aims to automate the issuance of stamps in Punjab.…

Taxable period The tax year for company tax return is starting from 1 July through 30 June. However, tax authorities…

FBR allowed to taxpayers to file settlement application for agreed assessment. The Federal Board of Revenue has issued a statement…

Bitcoin traded at $ 33,365 in Asia on Monday, hitting a record high of 34,800 on Sunday as investors bet…

FBR ISSUES CLARIFICATION (Federal Board of Revenue has issued a clarification regarding extension in Prime Minister’s Construction package.) Dec 31, 2020…

Government in Pakistan have introduced tax measures to reduce the impact of the COVID-19 pandemic in year 2020. Tax Reliefs…