E-Stamping, a flagship project of the Punjab Information Technology Board (PITB), aims to automate the issuance of stamps in Punjab. Since its launch in November 2014, e-stamping has now achieved a milestone of Rs.201.3 billion revenue in 2020 As of December 31, 2020. The total revenue collected using this e-stamping system is over PKR 201 billion. A total of 8.1 million e-stamps issued during the year with over 10.9 million transactions.

E-stamping ensures smoothing of property and business transactions in Punjab. This is to minimize the sale and purchase of fraudulent and counterfeit stamp papers. PITB has also developed a mobile app for auditors so that they can easily verify e-stamp paper and challan 32-A. The names of the buyers, sellers and the person through whom the stamps purchased entered into the system along with their CNIC number. PITB has also set up a central database for e-stamping system which has made the verification process easier for the citizens.

PITB along with other stakeholders launched several apps for the convenience of the people of Punjab. More recently, PITB has introduced a “Rasta App” to help you drive in thick fog. Similarly, for the convenience of teachers, PITB and SED jointly launched an online retirement system. All these projects are playing a key role in making the country digital.

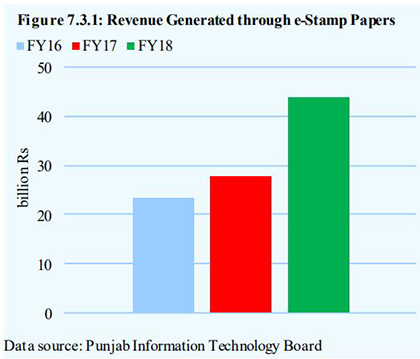

e-Stamping revenue generated in previous years

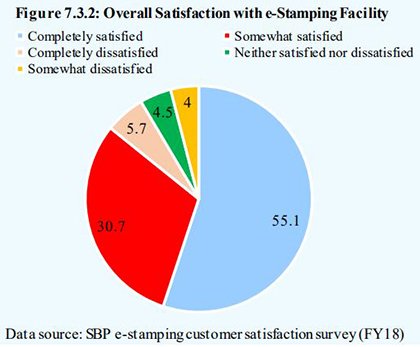

e-stamping facility satisfaction level

LATEST POSTS

- Tax Advice for 2024: Do not File Incomplete Tax Returns

Tax Advice for 2024: Do not File Incomplete Tax Returns Tax Advice for 2024: Do not File Incomplete Tax Returns. Whenever tax season approaches tax filer is busy in collecting and discussing his tax returns working with tax consultant and…

Tax Advice for 2024: Do not File Incomplete Tax Returns Tax Advice for 2024: Do not File Incomplete Tax Returns. Whenever tax season approaches tax filer is busy in collecting and discussing his tax returns working with tax consultant and… - Extension of Date in Submission of Sales Tax and Federal Excise Return

Extension of Date in Submission of Sales Tax and Federal Excise Return Extension of Date in Submission of Sales Tax and Federal Excise Return. Recently the Federal Board of Revenue (FBR) has extended the last date for submission of Sales…

Extension of Date in Submission of Sales Tax and Federal Excise Return Extension of Date in Submission of Sales Tax and Federal Excise Return. Recently the Federal Board of Revenue (FBR) has extended the last date for submission of Sales… - Tax Concept: Meaning & Types of Taxes in Pakistan

Tax Concept: Meaning & Types of Taxes in Pakistan Tax Concept: Meaning & Types of Taxes in Pakistan. In Pakistan, tax concepts refer to the principles of taxes that control the taxation system in the country. Here is the list…

Tax Concept: Meaning & Types of Taxes in Pakistan Tax Concept: Meaning & Types of Taxes in Pakistan. In Pakistan, tax concepts refer to the principles of taxes that control the taxation system in the country. Here is the list… - Rs 750 Prize Bond Draw List 15 April 2024

Rs 750 Prize Bond Draw List 15 April 2024 Rs 750 Prize Bond Draw List 15 April 2024. The 98th draw for the Rs. 750 prize bond is scheduled to take place in Hyderabad on April 15, 2024. Here are the details: Prizes of Rs 750 Prize…

Rs 750 Prize Bond Draw List 15 April 2024 Rs 750 Prize Bond Draw List 15 April 2024. The 98th draw for the Rs. 750 prize bond is scheduled to take place in Hyderabad on April 15, 2024. Here are the details: Prizes of Rs 750 Prize… - Active Tax Payer List 15 April 2024

Active Tax Payer List 15 April 2024 Active Tax Payer List 15 April 2024. Following is the active tax payer list issued by the Federal Board of Revenue (FBR) on 15th April 2024. This list contains the taxpayers details who…

Active Tax Payer List 15 April 2024 Active Tax Payer List 15 April 2024. Following is the active tax payer list issued by the Federal Board of Revenue (FBR) on 15th April 2024. This list contains the taxpayers details who… - Withholding Tax on Cash Withdrawal in Pakistan 2024 for Filer

Tax on cash withdrawals from bank

Tax on cash withdrawals from bank