Federal Board of Revenue (FBR) notified instructions for procedures of applying extension requests in filing income tax returns for tax year 2020.

Further instructions disappointed all stakeholders (tax consultants / practitioners, taxpayers, chambers etc.,) who have already requested to the FBR for extension of last date for Tax Year 2020. Last Friday, FBR has already cleared that it would not further extend the last date for filing income tax return for tax year 2020.

Pakistan Tax Bar Association (PTBA) has already requested in a letter dated: December 02, 2020 for extension up to January 31, 2020. There are many causes behind the extension reason, the main reason mentioned by the Pakistan tax bar: miscalculations in the tax return form.

Corona Virus a pandemic situation all over the world, require to provide further extension. Where cases are already increasing day by day and taxpayers are reluctant to do compliance. It is the need of the hour to provide a favorable environment in this situation.

FBR on Monday instructed to all the RTOs / LTUs regarding procedure of manual receipt of applications for extension to file income tax return for tax year 2020. This all shows that FBR not interested in extension of date for filing tax return.

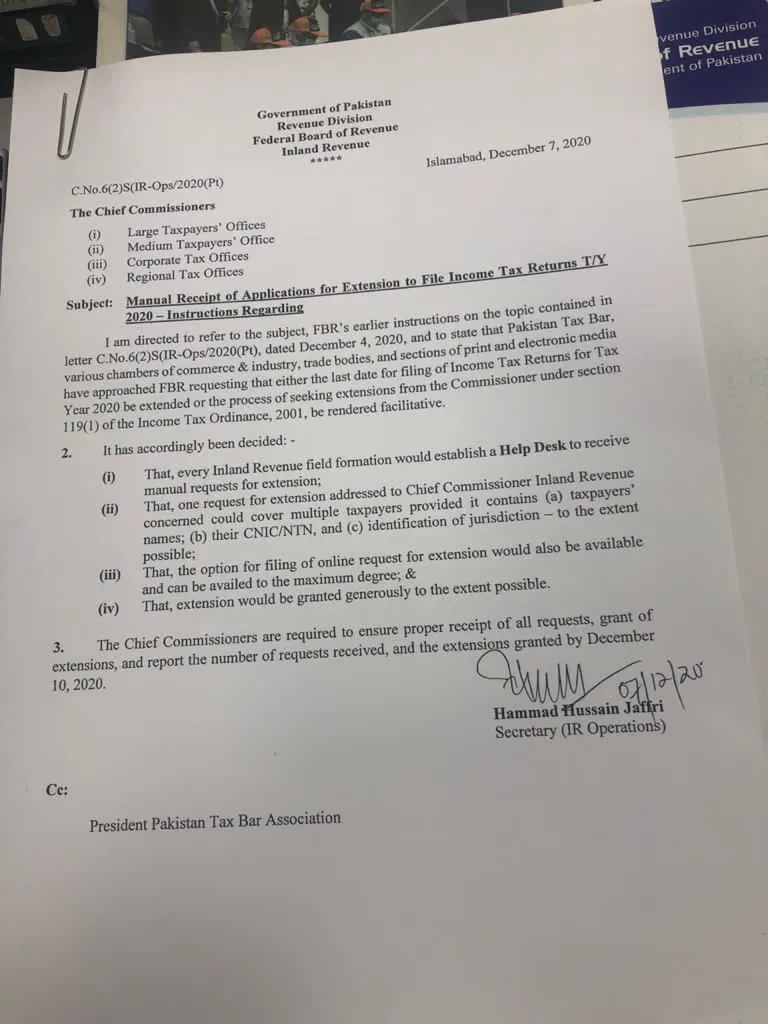

The FBR instructions reproduced here:-

(1)- FBR’s earlier instructions on the topic contained in letter C.No.6(2)S(IR-Ops/2020(Pt), dated December 4 2020 and to state that Pakistan tax bar various chambers of commerce and industry,trade bodies,and sections of print and electronic media approached FBR requesting that either the last date for filing of income tax returns for tax year 2020 be extended or the process of seeking extensions from the commissioner under section 119(1) of the income tax ordinance 2001 be rendered facilitative.

(2)- It has accordingly been decided

i)- That,every inland revenue field formation would establish a help desk to receive manual requests for extension.

ii)- That one request for extension addressed to chief commissioner inland revenue concerned could cover multiple taxpayers provided it contains (a) taxpayers names (b) their CNIC/NTN and (c) identification of jurisdiction — to the extent possible.

iii)- That the option for filing of online requests for extension would also be available and can be availed to the maximum degree.

iv)- That extension would be granted generously to the extent possible.

(3)- The chief commissioners required to ensure proper receipt of all requests grant of extensions and report the number of requests received and the extensions granted by December 10.2020.

LATEST POSTS

- New Taxes on E-commerce Transactions in Pakistan

- FBR Extends Sales Tax & FED Return Filing Deadline for June 2025

- Budget 2025 Update: FBR Broadens Definition of Online Marketplace

- FBR Opens Tax Return Filing Tax Year 2025 – Great Submit Now

- FBR Biometric Verification Mandatory by 31st July 2025 – What Taxpayers Must Know?

OLDER POSTS

- July 2025

- November 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020